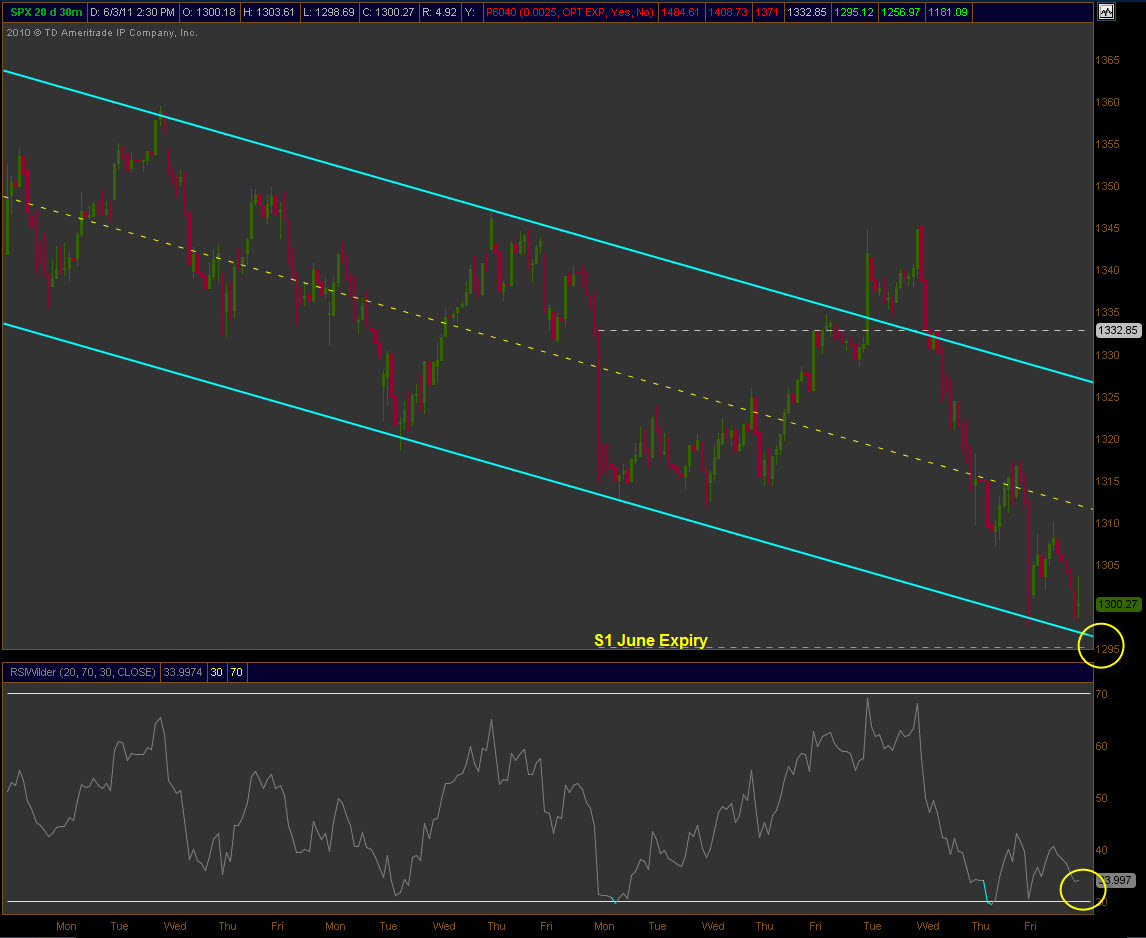

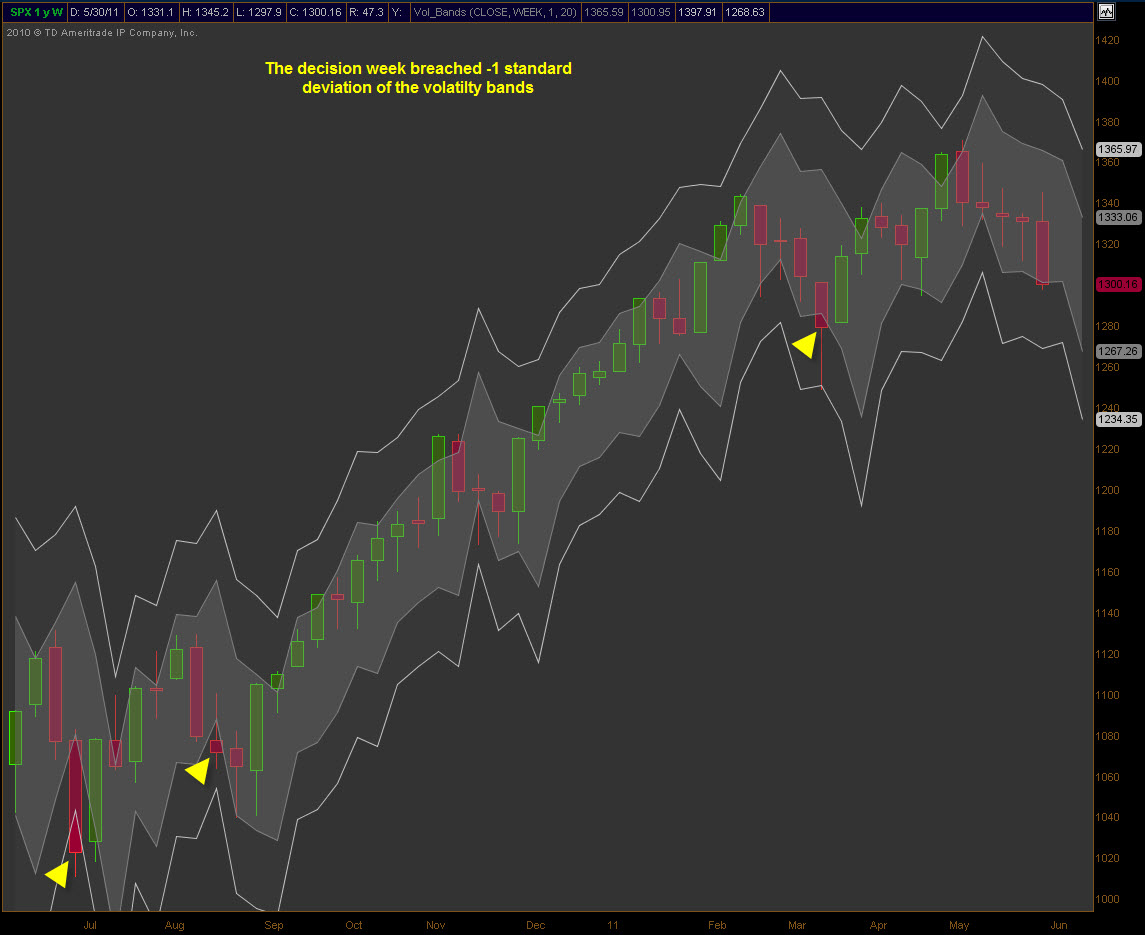

Well the indecision of the past three weeks was finally pushed aside in a bum rush to 1300 as selling ensued on a holiday shortened week. Can’t help but think many were leaning to the long side heading into the positive seasonality associated with this past week. Friday’s push lower to close near the lows of the week left 81.08% of the SPX components with an RSI(2) under 30. In the charts below you can see the carnage left behind and what looks to be a possible bounce scenario setting up.

There aren’t a lot of economic catalyst this week so focus will be on technical levels as well as the US Dollar. So much is going on around the world that the mindset of sell in May and go away may be the best medicine for many. However, implied volatility came in this week despite the SPX falling like it did and skew is indicating insurance is cheap. In other words, if a bounce is being expected, new longs could be protected very inexpensively right now. That makes it difficult to sell premium as I’d have to take on more risk than I’m comfortable with.

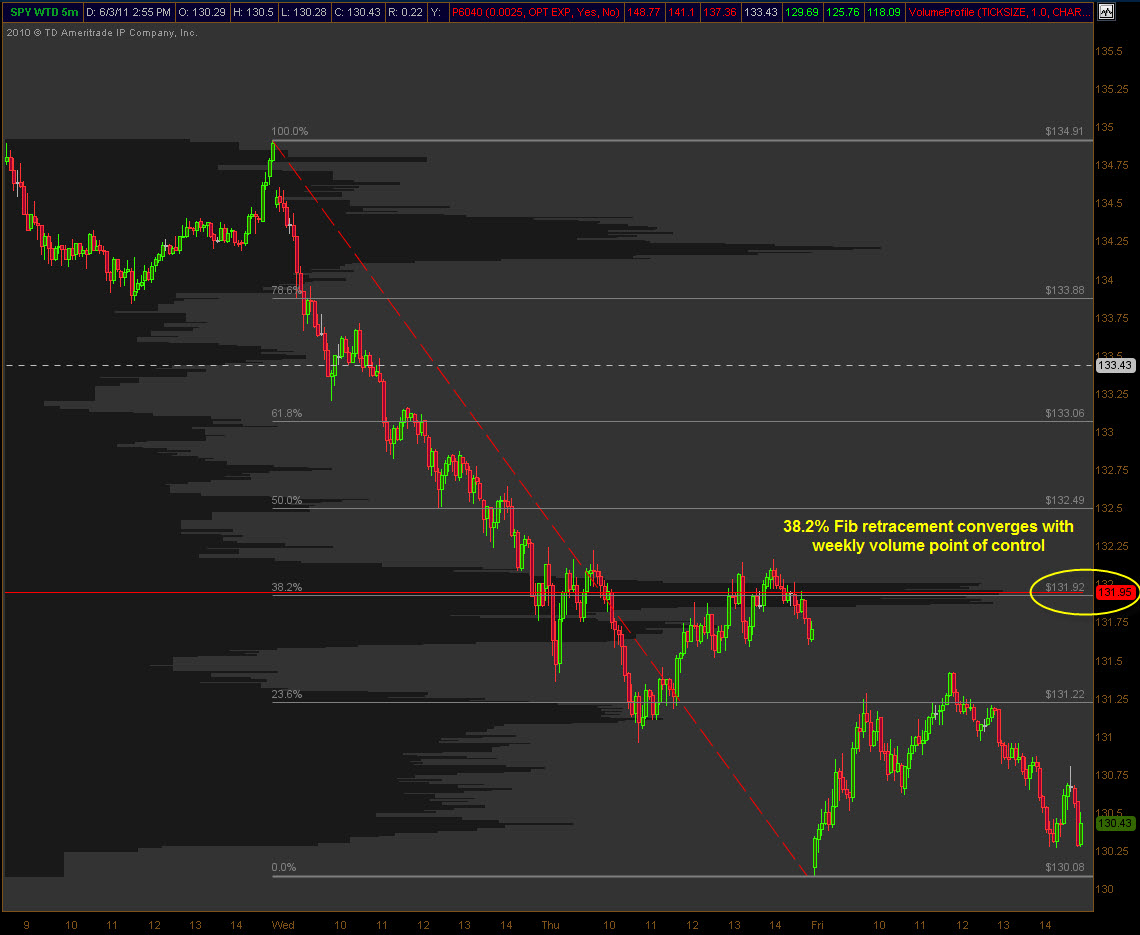

With two weeks left in the June cycle I’m not willing to push a trade all in the name of profit. Summer is here for me (and my family) and I tend to lighten up on my trading just from a logistical standpoint. I’m up nicely for the year and that makes the decision to not press even easier so that’s my mindset here. Although I reserve the right to continue trading if the right opportunity presents itself. I’m convinced that legging into weekly spreads is a great way to turn a profit and can even be done on a Friday. This past Friday was a perfect example.