Here we are with June expiry upon us and only 6 more months of premium selling left for 2011. Summer is always tough to gauge what’s going to happen in the markets and it seems that some months it’s more prudent to be invested lighter than normal. It’s always been a rule of mine to only invest 40% of my capital to any given option cycle and that simple rule has served me well over the years. When Summer rolls around I tend to cut that in half, especially if the front end of the year has been good to me. 2011 has been great so far and June will put me at a personal best as far as % return on risk.

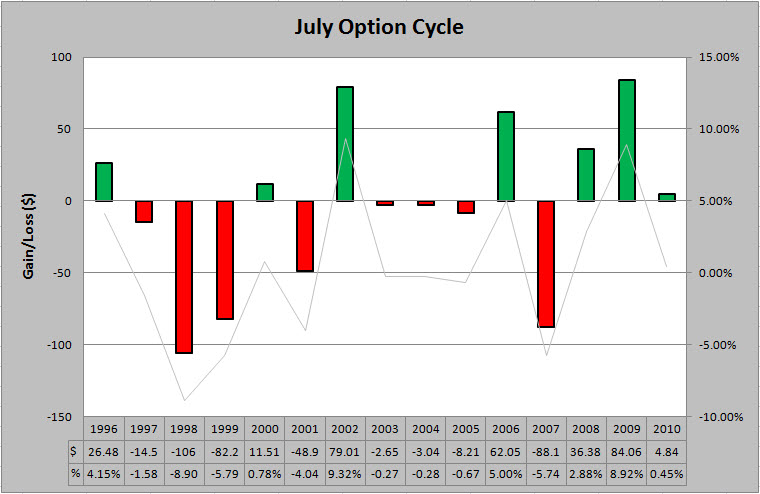

One of the many rituals I go through each month when deciding where to sell $SPX premium is to look at the historical tendency of the option cycle. To clarify, this is from the 4th Monday to the 3rd Friday. I’ve pointed out before that there is a difference between monthly returns versus option cycle returns. Below is the chart for the past 15 years of July option cycles with an average range of 88.23 points.