The ability of pattern recognition isn’t anything new or even earth shattering. My 5 year old in kindergarten is an expert at basic patterns with letters, shapes and colors. We learn from a very young age to look for patterns in all walks of life.

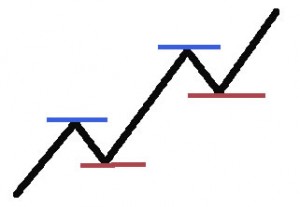

We could begin to see patterns in the drawing to the left and learn to predict or assume what has the higher probability of occurring next. As an example, looking at this pattern we might safely assume that the odds are greater that the line will move lower from here as it has in the past. This does not necessarily mean that it will, but the odds are in the favor of such a move. Information that we’ve gathered from the past can help us predict what the future may hold and this is the basic tenet of technical analysis.

Technical analysis can even be performed on your own trading account and patterns begin to emerge where you can recognize when your trading is “on” and when your trading is “off.” This ability to recognize the patterns as your account fluctuates in price is a decent beginning, but nowhere near the wealth of information that can be gleaned from your trading history. In order to make the most of each trade, winner or loser, you need to keep a detailed trading journal. Below is a list of what I’d recommend to have in a trading journal and, as with anything in life, you’ll get out of the journal what you put into it.

If you are able, attach charts to all entries. Something may not have stood out in the heat of the moment, but several days later you may see similar chart patterns to this one. It is at that time that you begin to find common threads and themes of your trading which will allow you to exploit those things you do well and avoid those things you do poorly.

The above should be easily done and would suffice for the most part. However, if you really want to excel at this then a “comment section” is where the real clarity comes from as you listen to yourself. Take a moment and run through questions like this to get a better understanding of what’s going of for you at that moment and document it. Here’s some examples of what you could ask yourself:

If you take the time to address questions like these then patterns will start to emerge as you begin to understand yourself and your individual trading style. As I’ve said before, you need to treat trading as a business as doing so helps you control your emotions. It is impossible to not be emotional when trading but it is possible to control your emotions.

The last suggestion I would have is that you open up a blog and use that as an electronic trading journal. There are several free services out there that allow you to create a blog and upload images, etc. The neatest thing about using a blog for your trading journal is the search function as each post or entry you make allows the use of tags or keywords. As an example, for every trade you make that is bullish, put the keyword bullish as a tag and later you’ll be able to search for that keyword. With a few clicks of the mouse you can see every entry that you ever made in your trading journal that has the tag bullish in it. Take a few moments and read through them and start recognizing patterns.

Here’s a few suggestions for resources that provide free blogs (in no particular order):

Write as often as you can in your trading journal and get into the habit of writing in it on a daily basis. When you close a trade take the time to capture your emotions at that point. A good idea is to come back and revisit your journal entries on a quarterly basis and add to them as needed when your emotions are removed from them. You might even begin to sense a change in emotion as you read your prior entries. Ask for others take on your trades by sending the link to a fellow trader. You could even ask fellow traders on Stocktwits to take a look. Bottom line is that you can learn a lot from prior trades if you take the time to document them.

lots of good ideas here.