We did see a bit more of a “climb” higher Friday as those who were in the market (not many) chose to be buyers for the most part. As an educated trader you should understand that without full market participation, any moves are seen as sketchy. Next week we have very little in the way of economic reports and earnings. In addition, Thursday of next week has the markets closed for New Year’s so another light volume week ahead.

The last five trading days of 2008 and the first two trading days of 2009 will constitute the “Santa Claus rally.” Typically the markets make higher highs and after Wednesday’s half day of gains and Friday’s price movement, it is off to a positive start. Monday we should see some increase in market participation but the volume is historically light through the New Year’s holiday. Look for volume to get back to normal on the 5th of January, 2009.

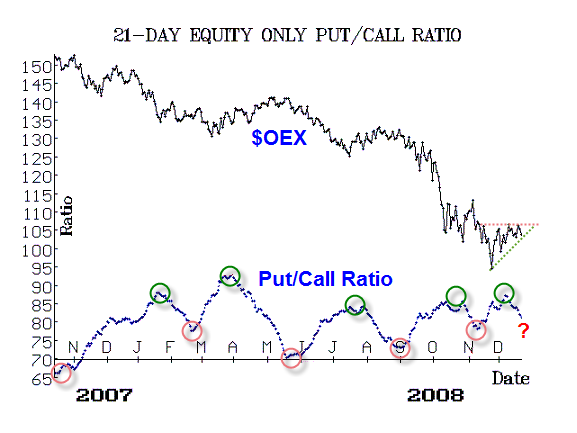

What to look for in 2009? Well, the bulls need to take the broader market higher, quickly, or some indicators that are currently bullish will turn bearish. Specifically, I’m referring to the 21-day equity only put/call ratio. The chart below shows the $OEX (S&P 100) and the average put/call ratio with buy and sell signals. You can see that the buy signal has fired a while back yet the $OEX still hasn’t broken out to a new high. Time is running out so a move needs to occur soon if the bulls have any hope of seeing a good start to the new year.

There are no scheduled economic events for Monday. There are no S&P 500 companies reporting earnings Monday.