Wednesday is what I’m calling the “event” where the $SPY ripped higher and never looked back. Thursday brought about a nice follow-through day, albeit on lighter volume. I like to track volume and feel as though it holds merit in certain areas of my trading. However, if you are on the wrong side of a trade and hold it simply because of waning volume you are lying to yourself. Why? Does your equity draw down care that the volume was light? I think not.

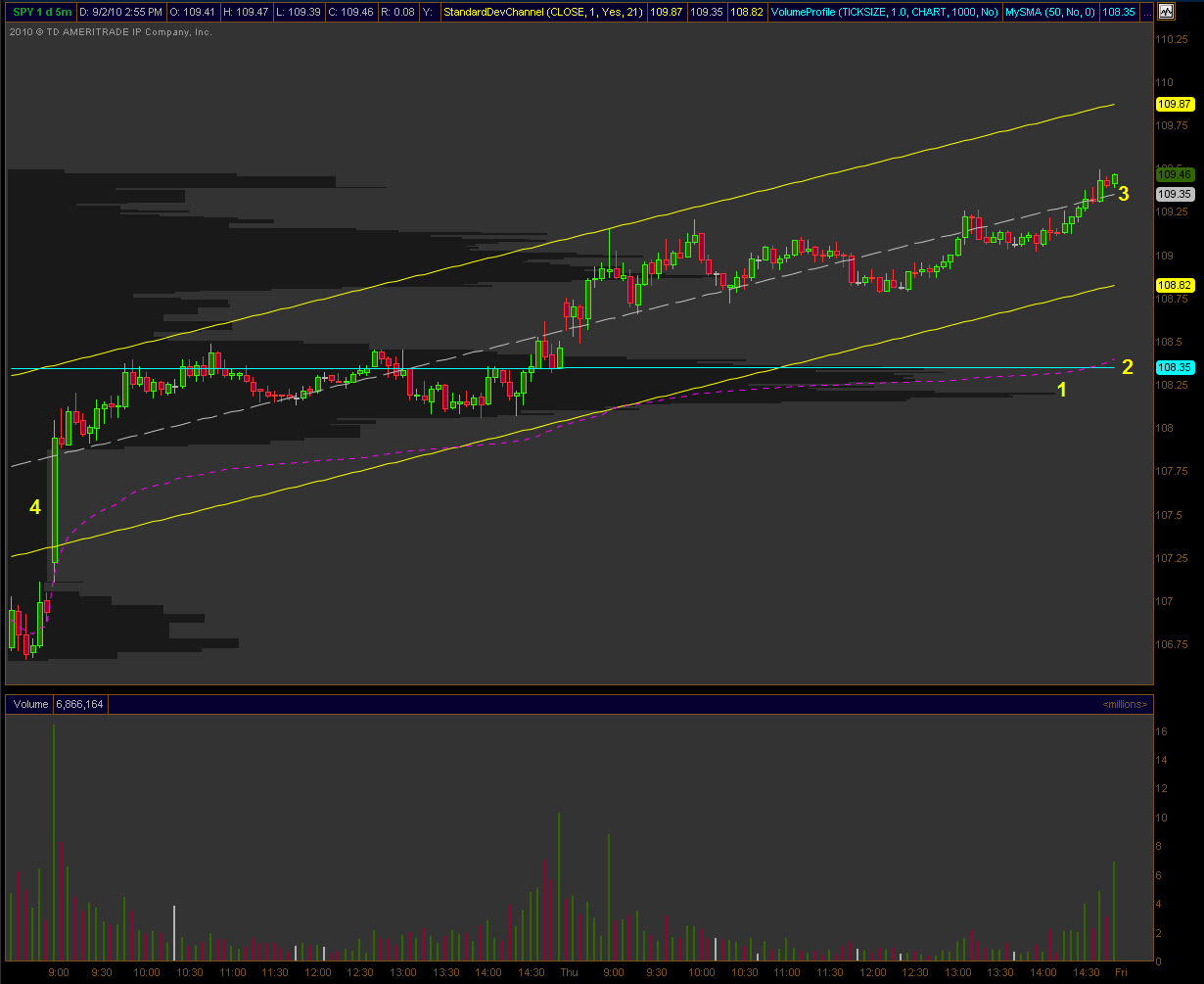

Below is a chart of the SPY over the past two days and some interesting levels and comments.

- The VPOC for the last two days is currently 108.20. This is the area of acceptance for both buyers and sellers since the event so it should hold as support.

- The VWAP (purple dashed line). This is the average price of a long since the event. Notice how the VWAP is above the VPOC and the 50 SMA (the 50-day simple moving average is the blue line).

- The mid-point of the standard deviation channel since the event. The SPY managed to close above it which suggest, along with closing near the highs of the day, that traders weren’t nervous taking a long into the non-farm payrolls.

- Finally the candle that really skews the event. Notice how there is very little volume here (on the profile) which suggests that not a lot of sentiment resides there. In other words, price could move right back through it very easily.

What will matter most to me tomorrow is how the market reacts to the jobs number and whether or not the trend for that day holds going into the close. I wouldn’t be surprised to see a dead market by 10:30. Have a good and long weekend!