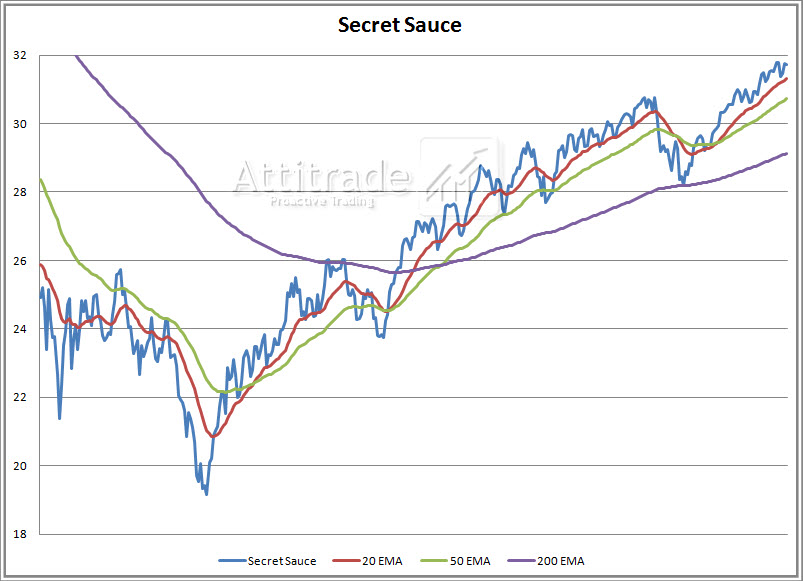

Everyone has, or at least should have, a proprietary indicator that they track. It’s more of a hobby for me and quite honestly it’s not that special of an indicator but I like it.  As you can see from the chart, the secret sauce indicator is still above the 20 EMA. It wasn’t too long ago that the 20 EMA crossed under the 50 EMA but the time spent there was rather ephemeral as the moving averages are still suggesting an uptrend is in place.

As you can see from the chart, the secret sauce indicator is still above the 20 EMA. It wasn’t too long ago that the 20 EMA crossed under the 50 EMA but the time spent there was rather ephemeral as the moving averages are still suggesting an uptrend is in place.

I’m not suggesting that I do nothing but trade to the long side as I use the secret sauce to help me with my overall bias. In other words, I’m not getting short the market here yet I’m not all in long either. There was a pullback recently and now it looks to test the high and that will either be resistance or a new buying opportunity. I think the pullback couldn’t have come at a better time as we are a few weeks into earnings season and the market is starting to give some clues here.

As a premium seller I’d look to initiate smaller short positions by selling $call spreads (with occasional put buys) when the 20 EMA is broken and would add to them with a break of the 50 EMA. If we make higher highs this week I’ll stick with selling premium with $put spreads and buying the occasional call.

While I agree that the bias is still to the upside, I disagree with the analysis that we rely on a moving average crossover. What we should be looking at is sentiment and where it is relative to historical levels.

Right now the Bull-Bear spread is nearing 37%. Just a few short months ago we all experienced a 9% market correction when this sentiment reading got to 37.5%, and when it reached 42% back in 07 it started one of the worst bear markets in history. Now I'm not suggesting anything so drastic, just that historically when the bull-bear spread enters the 35-40% range the markets correct.

My prediction is a mild 3-5% correction.

I'm not so much a proponent of an MA cross either, except that I use it with this indicator. I am an technician though.

I agree with your take on sentiment, especially as an option trader. Thanks for your input Ernie.

I'm not so much a proponent of an MA cross either, except that I use it with this indicator. I am an technician though.

I agree with your take on sentiment, especially as an option trader. Thanks for your input Ernie.