Poor trading habits are difficult to overcome, especially those that have been a part of a trader’s routine for years. Part of the reason is that habits are perfected through experience. Habits can be formed and reinforced through expectations (from one’s self or others), triggers (smells, visuals, etc.) and even market conditions.

Poor trading habits are difficult to overcome, especially those that have been a part of a trader’s routine for years. Part of the reason is that habits are perfected through experience. Habits can be formed and reinforced through expectations (from one’s self or others), triggers (smells, visuals, etc.) and even market conditions.

Research suggests that we never truly forget our habits but overwrite them with new ones. If the old habit isn’t replaced with a new one then it can resurface. One way to replace a poor trading habit is to focus on the point of performance rather than the habit itself. This is where we as traders need to be on point or on task. To put it another way, the WHAT, WHEN and HOW of our trading system.

Ask yourself these questions the next time you’re ready to put capital on the line to assess whether or not you’re on task: [list type=square_list]

- Am I doing what I’m supposed to be doing (WHAT)?

- Is this the right time to do it (WHEN)?

- Am I following my system (HOW)?

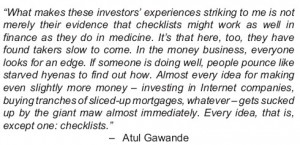

It’s the third item I’d like to focus on for the remainder of this post. Checklists are vital to trading success yet they are widely overlooked and even shunned. In his book “The Checklist Manifesto” Dr. Gawande writes “Under conditions of complexity, not only are checklists a help, they are required for success. There must always be room for judgment, but judgment aided – and even enhanced – by procedure.”

Trading is a high-pressure environment where simple mistakes can be costly. The biggest benefit of using a checklist is the process itself. Creating a checklist removes the potential of simple mistakes caused by missing a mundane task (forgetting to check the earnings date or clicking the buy button instead of sell button). In addition, a check list frees up vital working memory which can then be allocated to the discretionary side of our trading system.

Another benefit of a checklist is that it forces us to be detached and systematic about certain key aspects of our trading system. Aspects such as calculating trade size or stops (managing risk) which should be systematic rather than discretionary. Just as a pilot would not fly until they’ve gone through a rigorous checklist, we shouldn’t trade unless we’ve gone through our checklist. In a sense, checklists are a form of discipline which is something we can all improve upon.