While pursuing my doctorate in ’99 I had the opportunity to see Dr. Albert Ellis give a lecture in Pittsburgh and will always be grateful for that. He was the old curmudgeon and everything that I expected. For those that don’t know, he created rational emotive behavior therapy (REBT) and I used it with several of my clients over the years.

While pursuing my doctorate in ’99 I had the opportunity to see Dr. Albert Ellis give a lecture in Pittsburgh and will always be grateful for that. He was the old curmudgeon and everything that I expected. For those that don’t know, he created rational emotive behavior therapy (REBT) and I used it with several of my clients over the years.

REBT is a cognitive therapy and thus focuses mainly on thought processes and works from the assumption that, for the most part, we as humans are our own worst enemies. I for one can attest to this notion as I’ve seen it play out in my own life on several occasions.

One of the key pitfalls that we tend to fall into is what Ellis called “musterbation.” When you hear yourself saying things like “I must get into shape” or “I must make $ 1000 a day trading” you are musterbating.You can substitute “should” “need” and other similar words and get the same result.

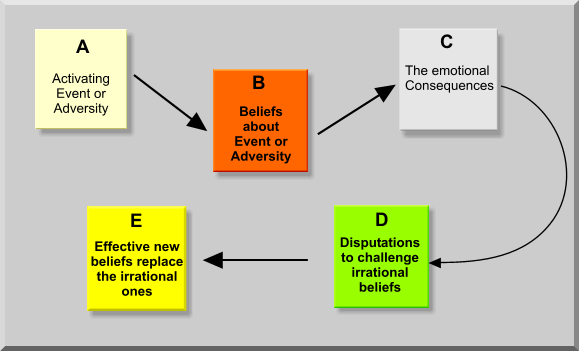

The cliff notes version of REBT can best be summed up in the image below. The belief (B) that we have about the musterbation statement (A) leads to an emotional consequence (C). It’s the irrational belief (B) that is screwing you up and that’s where the work needs to begin (starging with D).

At times, the beliefs become debilitating in that confidence suffers and focus becomes less objective in favor of the irrational beliefs. As I mentioned earlier, a belief that I’ve heard numerous times as a mentor was something like “I need to make $ X a day.” It’s good to have goals, but it’s what happens if those goals aren’t met that causes issues. If I don’t make $ X then I’m not a good trader and I’ll have to move to the next strategy/market to become a better trader. If I don’t make $ X today then I’ll have to assume more risk tomorrow and make $ 2X . Before long, that $ X per day becomes your worst enemy as it saps your mental energy.

This is just one example of musterbation and I’m sure you’ve thought of a few while reading this post. The worksheet above was created by other cognitive behaviorist to help their clients overcome the irrational beliefs. I used something similar with my clients back in the day and thought you might find it useful.

Bottom line is that with the New Year upon us I know many people like to create goals and tend to set the bar a bit too high at times. One suggestion I’d have for those that focus on making $ x/day is to rather focus on stopping trading if $ x is lost/day. Think about that one for a minute. How about a goal of becoming a better trader by doing X,Y,Z? It could be managing risk better, practicing a strict stop strategy, keeping a trading journal, whatever. The point is that if you become a better trader then the $ X/day takes care of itself and you avoid putting undue pressure on yourself.

I’d love to get your thoughts/feedback on this. Perhaps you have something that works for you, let me know what it is. Whatever goals/aspirations you have for 2010 I hope that they contributes to a better quality of life for you. Let’s roll!

Good post, Darren. I sometimes wonder why I've drifted from setting concrete daily/weekly/monthly goals, as I spend most of my goal setting on just getting better at process. I find it important to track results in order to measure progress, but have a reluctance to impose my profit goals onto a market that may or may not offer the same level of opportunities from one period to the next. Still working on achieving that balance…the longer the period the more similar the # of opportunities, but you then lose a little touch with how you are doing vs. goals. Thoughts on how you achieve this goal setting balance?

A few years ago I read the book “Goal-free living: How to have the life you want NOW!” by Stephen Shapiro as the title intrigued me. I couldn’t imagine myself living without goals because they were my motivation, my measuring stick. Shapiro isn’t totally against goals, just an over-reliance upon them and that’s kind of where I was.

Today I focus more on aspirations, such as becoming a better trader, but I also track performance by percentages. I believe that managing risk is part of becoming a better trader and thus, if I take a loss, it will directly impact my percentage. If I diagnose my trade and figure out what went wrong, then I am less likely to repeat the same/similar mistake in the future and thus increase my percentage.

Here’s a link to a small snippet from Shapiro on his site. The book is a good read as the title is a bit misleading. http://www.goalfree.com/video/gflclean.PDF