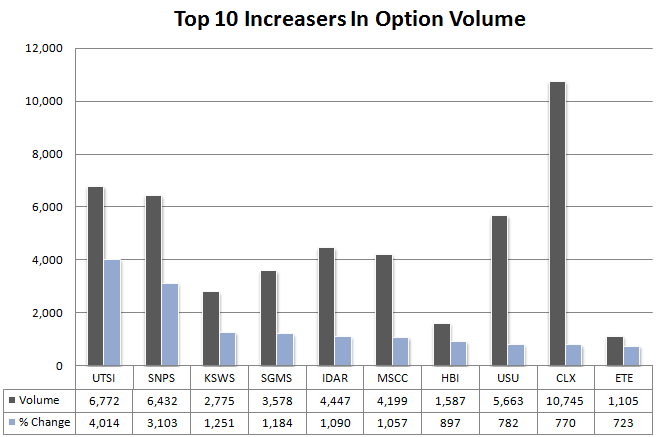

Some bullish movement again today as reports are out that “short sellers” are closing up shop. Doubt it, but we’ll see. Let’s take a look at the option activity in today’s market. Look at the option chains for the stocks listed below as their option activity has seen some tremendous increase today. Typically you can see what others are thinking by looking at the option volume and perhaps see some institutional action as well.Take $SGMS (scientific games corp) for example. Today saw over 3.300 calls for the Jan. 09 $17.50 calls go out.

The put/call ratio is a key indicator of sentiment towards a stock with high ratios signaling bearish sentiment. If you look at the charts for these companies and see them approaching resistance then that would make the high put/call ratio logical from a technical perspective. However, if there aren’t any levels of resistance ahead then the chances increase that the high put/call ratio might be fundamental in nature.