Earnings are a great time to look for some quick and explosive moves in some names and then structure an option strategy around that to possibly profit from such a move. Digital River $DRIV has earnings on 11/3 and has been taken out behind the wood shed lately as Symantec ($SYMC) said they would not extend its existing e-commerce agreement. Add to that the snafu of the recent $MSFT download errors and $DRIV is set for a decisive move in either direction.

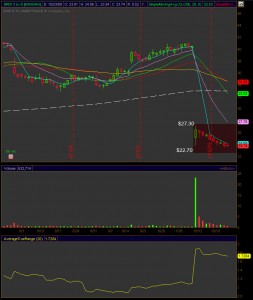

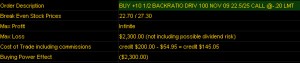

The ratio back spread is designed to profit from a quick and decisive move that has a catalyst such as earnings. I found this one below that involves selling the November $22.50 call and then purchasing twice as many $25 calls. The nice thing about this ratio spread is that it can be put on for a small credit so the possibility exists to make money on the trade even if the direction is wrong. The break-evens for this trade are $27.30 on the topside and $22.70 on the downside and if you look at the chart you can see that $DRIV has been trading in that range since the $SYMC news.

Of course the risk in the trade is if $DRIV fails to move outside of those break-even levels mentioned above. The spread is a $2.50 spread and the credit received for putting it on is $.20 so the maximum risk for the trade is $2.30 per contract ($230).