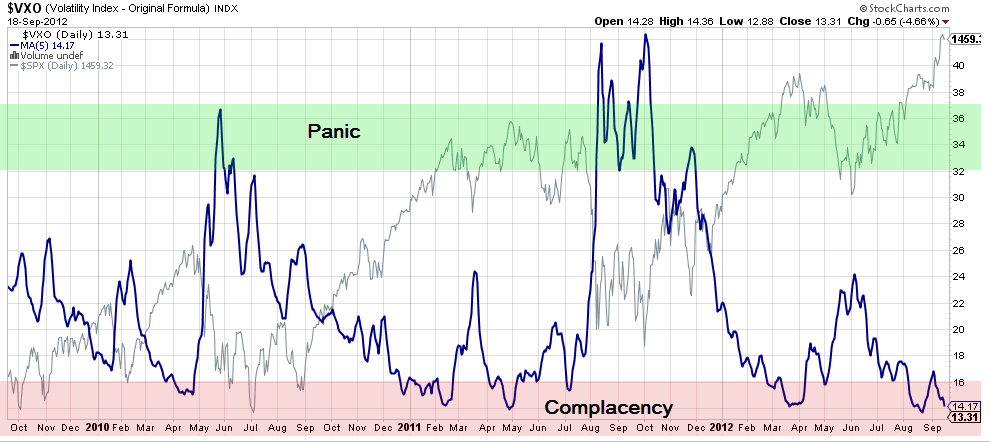

There’s no denying that the market was overextended as a result of last week’s Fed decision. So far this week we’ve seen a small pullback in price while many of the short-term indicators have worked off their overbought readings. As long as price stays above the 5-day SMA and the net delta leaning bullish for opex this week I don’t want to be short here. Take a look at the 5-day moving average of the VXO below.

The average is firmly in the complacency range, again, as the S&P 500 treads water just under R2 (1478.17) for the September option cycle. If you look to the left of the current close you can see that when VXO is in the shaded red area that the market tends to pull back (it made new multi-year lows ahead of the Fed). However, it’s not a given and thus it should be used as a confirmation to other indicators in forming an opinion about the market.