What is a butterfly option spread?

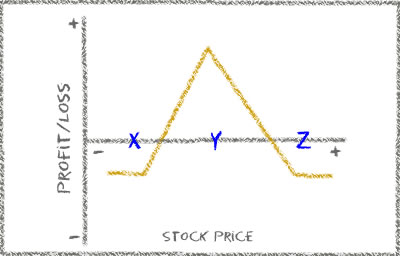

This trade requires three separate positions (four total contracts), and is therefore a bit more complex than the collar. It can be made using either put options or call options. For simplicity, we will use calls in this example. To execute this trade, the investor will need to buy two calls — one at a low strike price (X) and one at a higher strike price (Z). The investor also needs to sell two options with strike prices at or near the current price (Y). In the end, this type of trade will pay the maximum amount if the stock finishes at the middle strike price (Y). The long call you bought at the lower strike (X) has made it’s maximum intrinsic gain and the two options you sold at the middle strike (Y) expire worthless and you keep the premium. You also have to account for the lost premium on the further OTM strike (Z) as it expired worthless as well. The trade has very limited downside risk, but the trader must estimate the correct future stock price to a fairly narrow range in order to make the trade profitable.

Traders often use the butterfly strategy when they feel a particular stock will remain neutral during a certain period. By entering into a butterfly trade, the trader is essentially betting that the underlying stock price will remain close to where it is currently. That’s not to say that the stock can’t move higher or lower between now and expiration, it just means that by the third Friday of the month the stock price needs to be close to the Y strike.

To learn more about the Butterfly Option Strategy or any of the other advanced option strategies please enroll in our educational offerings. You will have access to all of our resources to help you become the trader you want to be. You truly risk nothing as we offer a 14-day free trial so come on in and kick the tires!