I recently closed a position that had me short the November 125 calls in $IBM (with protection via long 130 calls). While I would have liked to still be in that position, I chose to close it recently to avoid a potential loss. One of my favorite strategies is to sell premium post eps at a level that 1. has enough premium to make it worthwhile and 2. is at or near a level that was prior support/resistance. The 125 level for $IBM has been prior resistance and I felt good with the ammount of premium I received for the trade.

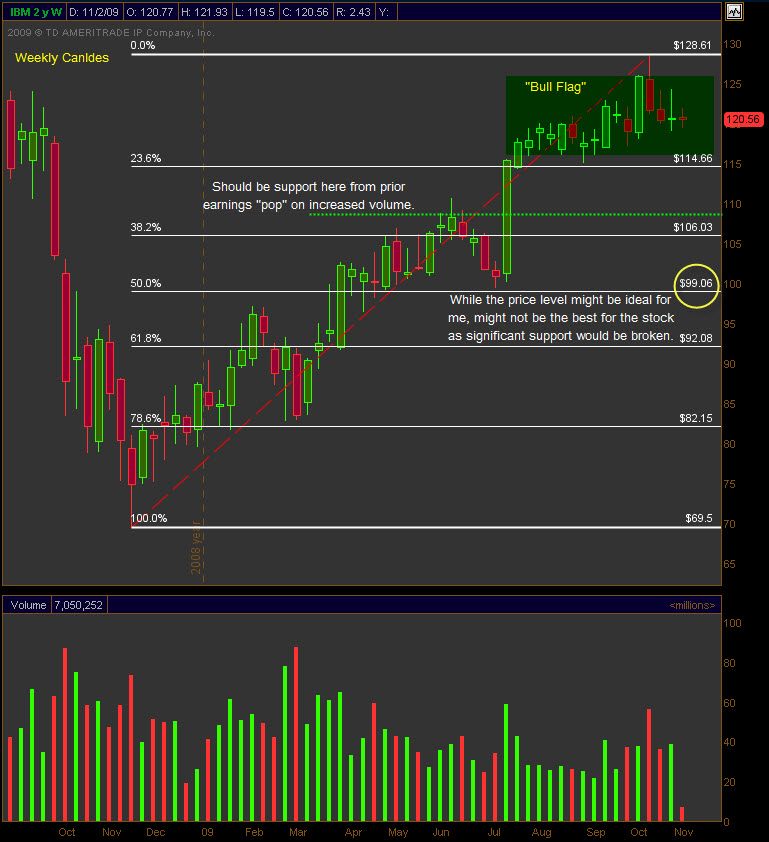

Shortly before I closed the position, $IBM came out and said that they were buying back $5 billion worth of stock. Yet another way that they continue to deliver for the shareholders of the company. I’m actually looking for a better entry to purchase the stock outright and use it two write covered calls on in one of my IRAs. Ideally I’d like to see the stock pull back to the 100 level and that puts it at about the 50% retracement off the past year’s gains. However, that may never happen but I’m willing to wait and watch patiently. The market as a whole is due for a pullback and $IBM is one of the main names on my list to get long once the dust settles.