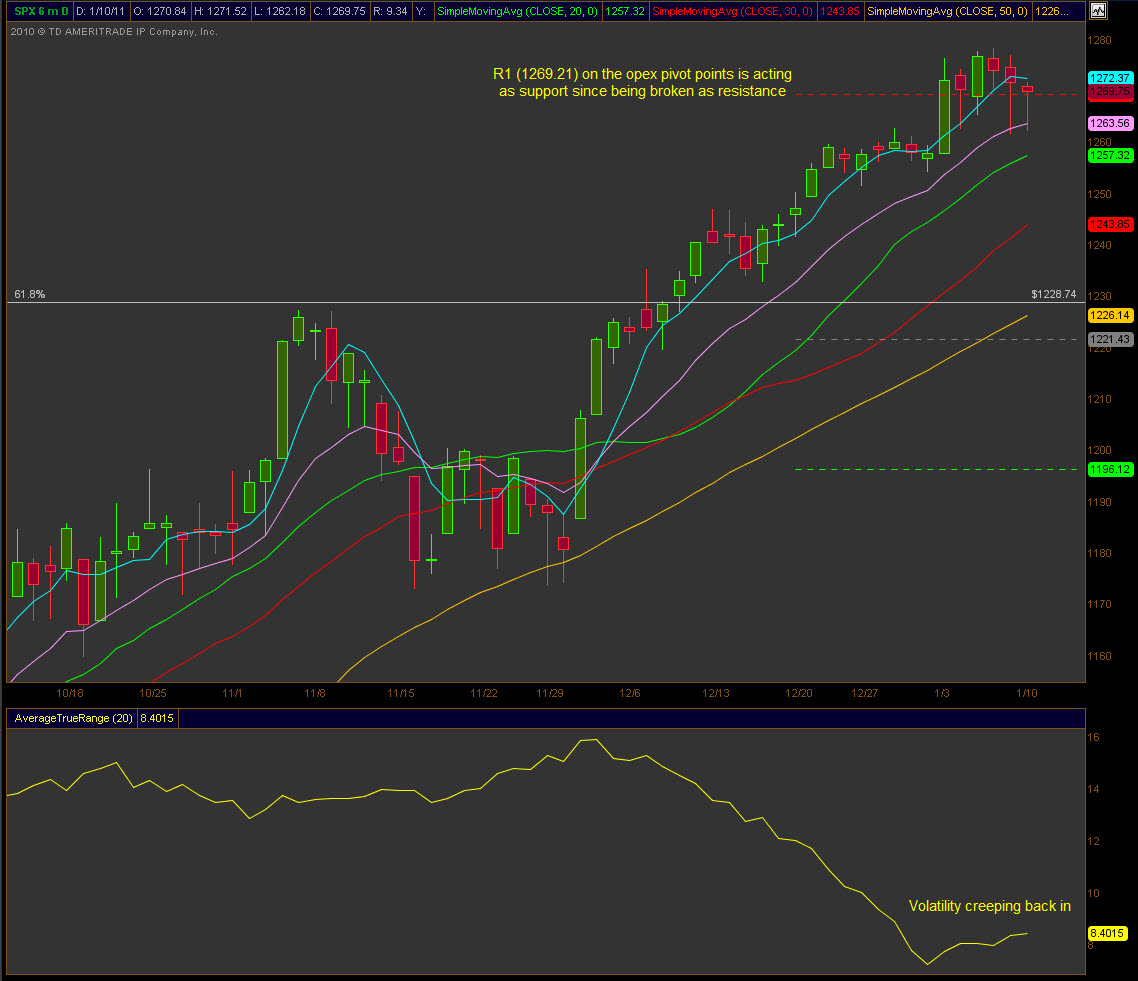

Something noteworthy is going on and occurs more often than most may know. I’m referring to pivot points acting as support/resistance. Most traders are familiar with pivot points and they come in many flavors. One of my favorites is the opex pivot based on John Person’s work. The calculations are from opex to opex rather than month to month and can, at times, provide some great insight into the trend. In the chart below you’ll see that during this three day pullback in the $SPX the R1 pivot has provided support. Just like any level of resistance that has been broken, the expectation is that it will become a level of support and so far that’s the case.

The chart below shows the “traditional” R1 for the monthly pivot as being 1284.63 which is over 15 points above the opex R1. Now I’m not betting the bank on any one indicator but pivots do play an important role in my market participation. I think they add value to my overall thesis and once January option expiration has come and gone there’s still 6 trading days left in January. Why does that matter? I’ve noted before that there are differences between opex returns versus monthly returns and these pivots can be a great resource to recognize important levels.