Not the best of weeks for the equities, but with Friday’s limit down action in the futures it could have been much worse. The major indices were DJIA lost 5.3%, the Nasdaq lost 9.3% and the S&P 500 lost 6.8% for the week. For the year, the Nasdaq leads all with a whopping 41.5% loss followed by the S&P 500 at a 40.3% loss with the Dow suffering the least with a 36.8% loss.

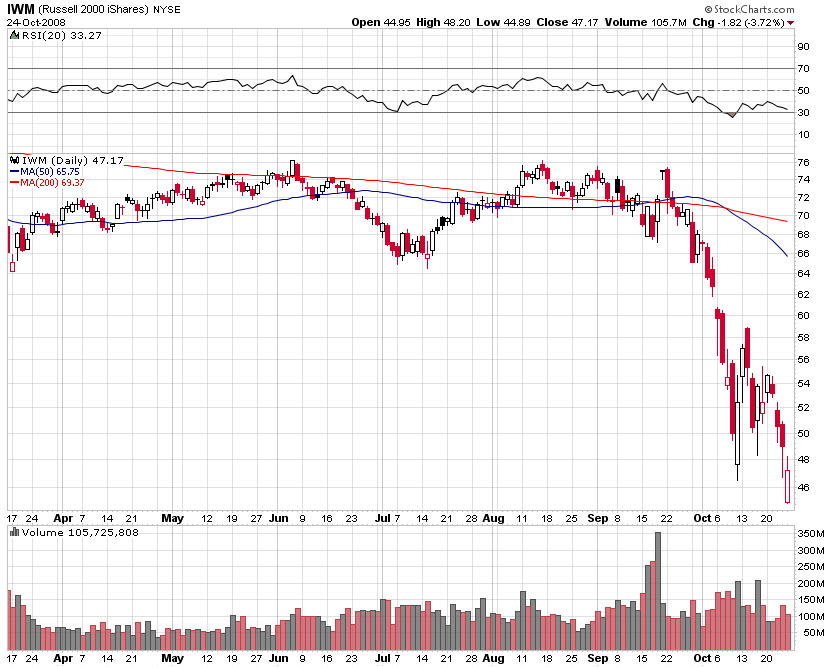

The Russell 2000 ($IWM), which represents the small cap stocks, was taken behind the woodshed this week as it turned in a 10.5% loss. For the year it is down 38.5% which is about par for the course when compared to the major indices.

There has been lots of talk lately about a capitulation day and how the equities really need to take one on the chin. Friday’s open looked like the chance, but for some reason the markets held their own. There is quite a bit of data coming out next week, highlighted by the FOMC statement on Wednesday. Watch for Monday’s action as there is quite a bit of talk about that being the potential capitulation day the bulls want.