The $SPY finds itself at the proverbial crossroads and it seems that everyone has an opinion of what’s about to occur so I thought I’d muddy the water a bit more (that should fulfill my blues reference quota for the quarter). Below are the weekly price targets for the broader index and a few other key levels I’ll be watching this coming week.

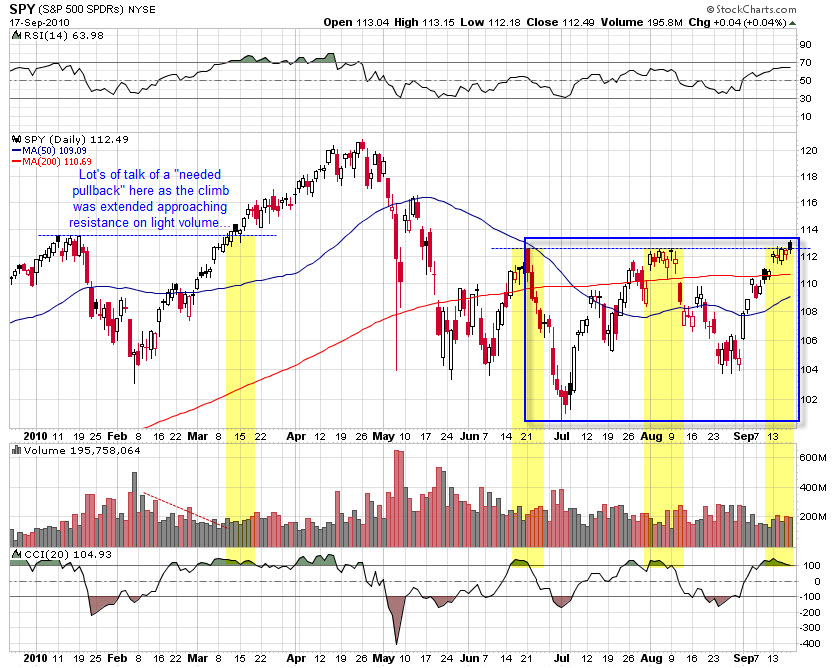

![]() Looking at the chart below there are lots of technical levels that one could watch and the importance of each depends on your trading style. A few of note to me are the Volume Weighted Average Price (VWAP) of the price action in the blue box which I consider the summer of the iron condor. That VWAP is 108.56. One other important VWAP I’m aware of is the post “flash crash” and that level is 109.44. One other key level for me is 114.10 which is the 61.8% fib level from the 4/26 high to the 7/1 low.

Looking at the chart below there are lots of technical levels that one could watch and the importance of each depends on your trading style. A few of note to me are the Volume Weighted Average Price (VWAP) of the price action in the blue box which I consider the summer of the iron condor. That VWAP is 108.56. One other important VWAP I’m aware of is the post “flash crash” and that level is 109.44. One other key level for me is 114.10 which is the 61.8% fib level from the 4/26 high to the 7/1 low.

From a seasonality standpoint the SPY has some pretty strong historical evidence which suggests a pullback Monday and a run into the FOMC on Tuesday. I have a position in the $SPX quarterlies which expire in two weeks and am prepared to see a prairie dog effect with the head poking into the 114 area. The ingredients are there for a break which will make for an exciting week.