It’s all about the jobs this week with the ADP on Wednesday and non-farm payrolls on Friday. Alcoa ($AA) reports on Thursday after the close to officially start earnings season. However, we have about 3 weeks before a clear picture of earnings season performance will be discernible. Here’s the complete economic calendar for this week.

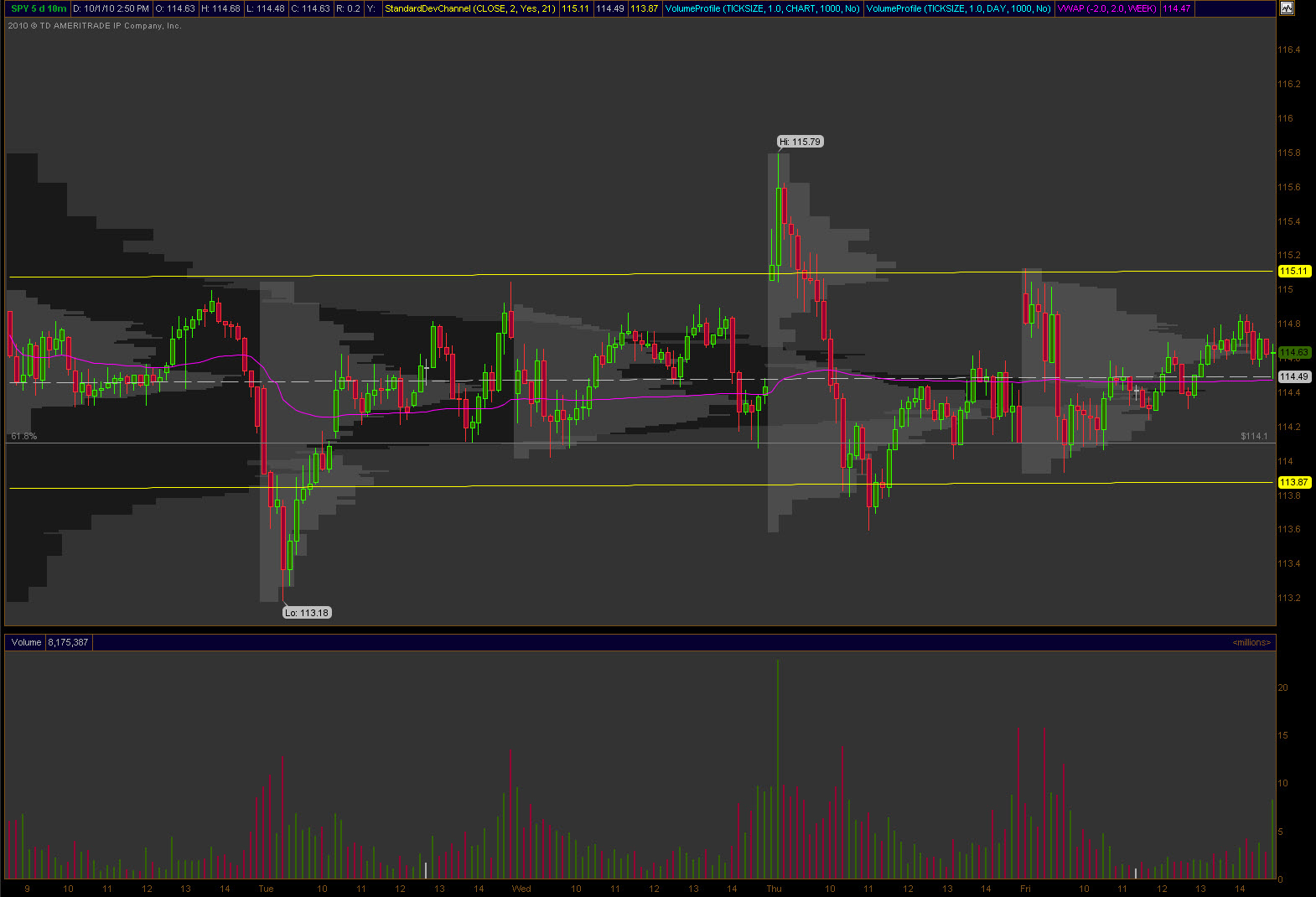

We are stuck in a range, it seems forever, and while that’s the perfect scenario for a premium seller like myself it’s also unnerving. A few catalysts could cause a break of the range and at this point the greater risk is a break to the upside as recent levels of resistance were broken and have yet to be tested as support.

Here’s a few levels from last week that I’m watching that allow me the opportunity to plan now for my reaction if they are broken. I truly believe in being a proactive trader and the weekends are the perfect time to assess what I’d call “action areas.”

- VPOC = 114.41

- VWAP = 114.47

- +2 Standard Deviations = 115.11

- Midpoint = 114.49

- -2 Standard Deviations = 113.87

- High = 115.79

- Low = 113.18

I’ll be looking to leg into put spreads this week for the October cycle as I’m fully invested on the call side and my Delta is a bit too negative for my comfort level. I feel comfortable in where I sold premium as it would take a lot of momentum in the next two weeks to touch my level. Should be a good week and perhaps with the jobs data and the start of earnings we are close to seeing the type of catalyst needed to break the recent range. Weekly price targets based off of volatility below.

![]()