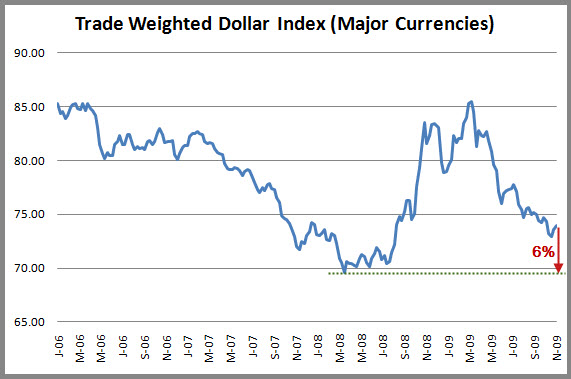

As everyone knows it’s been about the dollar for some time now, but it’s always about something, right? The scary thing is that most of us use the DXY or $USDX or, even more misleading, the $UUP to track the dollar’s dive. Instead, I suggest that a look be given to the trade weighted dollar index of major currencies. This data compares the Dollar against a basket of major foreign currencies and Marc Chandler does a good job here explaining it.

Bottom line is that if the current correlation between the all mighty Dollar and equities continues then the Dollar has about a 6% drop left to get back to the 2008 levels. That’s right, more downside potential. The best “bang for your buck” would come from companies that get a majority of their income (sales) outside the US. The Dollar will continue to fall as long as DC continues to show a lack of fiscal discipline. The scary thing is that this past week saw that with every $1 the government received nearly $2.30 went out giving us a nice $1.4 trillion deficit.