The past few days the $SPX has attempted to break out and has failed to keep a solid close. If you look at the individual sectors within the broader market you get the best picture of where the trades are. The weaker sectors of late have been energy ($XLE) and financials ($XLF) while the stronger sectors have been health care($XLV) and utilities ($XLU). The move isn’t a stampede as riskier high beta names are put aside in favor of low beta high dividend names but those who do their homework will have plenty of opportunities to participate when the stampede does occur.

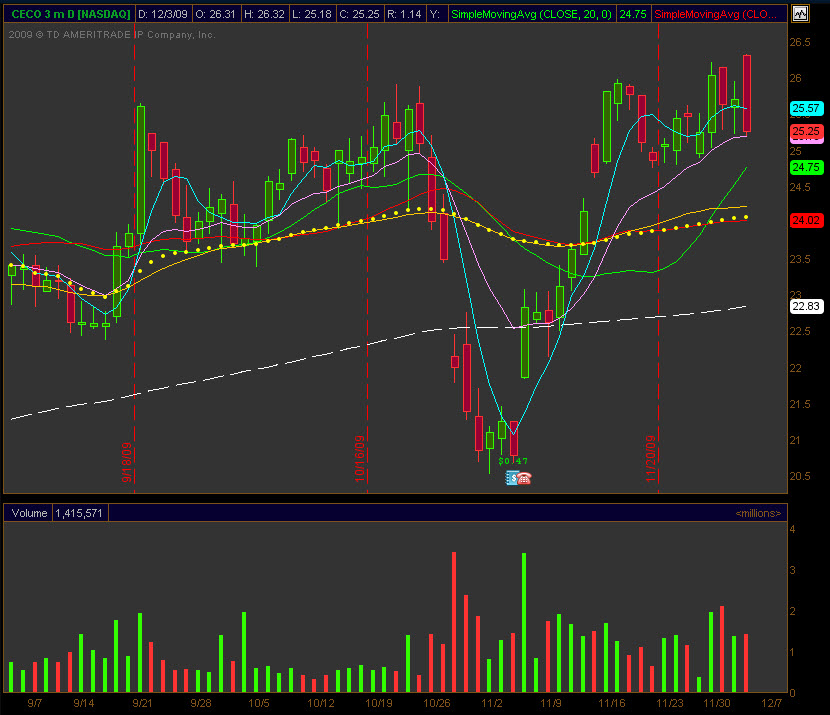

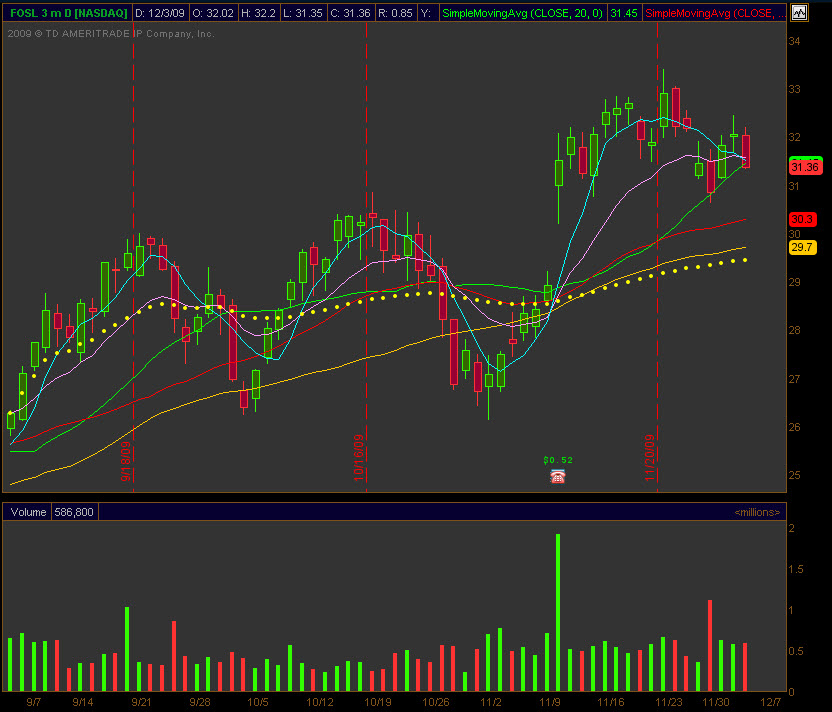

I’m not calling for a top and never do, but as I’ve said before it never hurts to have a list of potential candidates. One of my favorite scans that I run about once a month looks for stocks that have gapped up at least 5% in the last 20 days. Some times the gap has been filled and the stock has moved on while other times it give a great target. here’s a few of the names I’m watching and you can download the entire list here.

If the market does decide to move lower then the move higher in health care and utilities will continue. It would be best to start building a list of names in these sectors if you don’t have one already. I tend to look for the under performers relative to the sector and in the utilities I like both $FE and $FPL.