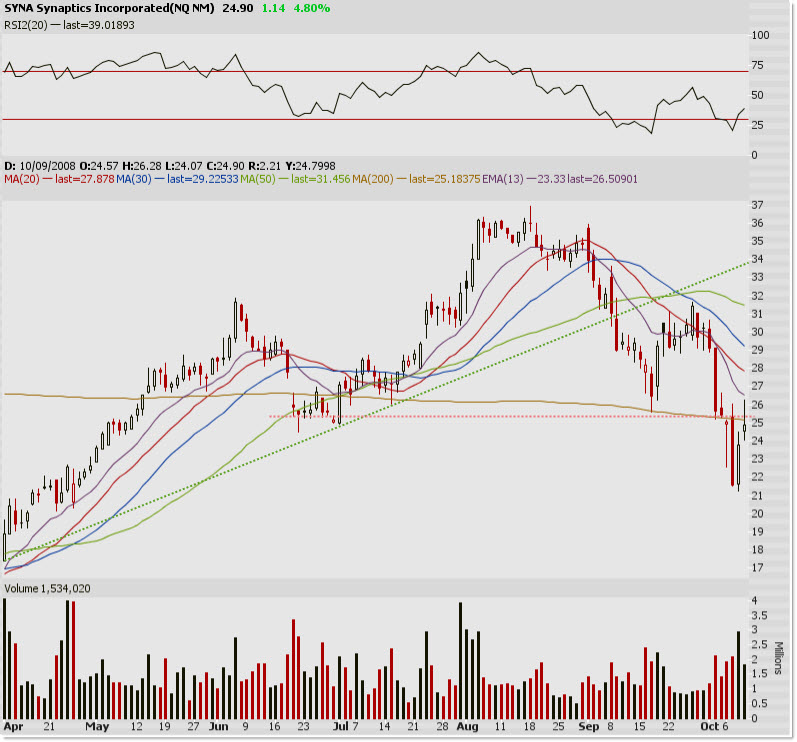

When you’re not trading you find fun things to do and I did today. I started looking at short ratios for certain stocks that have decent volume and within a certain technical pattern. I found one that I wanted to point out a few items of note as these numbers are pretty amazing. Chances are that this company built the touchpad on your laptop or keyboard—Synaptics, Inc.( $SYNA). The short ratio is 70% of the Float which translates into 13,618,100 shares short. Based on the average daily volume of 1.3 million shares, it would take nearly 10 ½ days to cover those shorts.

SYNA is just one example and that is what some people are gearing up for as contrarian investors. In other words, there are those out there who are waiting patiently for a “short squeeze” rally. The way a short squeeze rally works is that the traders who are short start to buy back to close their positions. At the same time, traders who want to get long the stock are buying as well. Nobody wants to be short so the market makers, and others, increase the ask knowing they will get it. IF a short squeeze does happen in the market, you will definitely notice it.