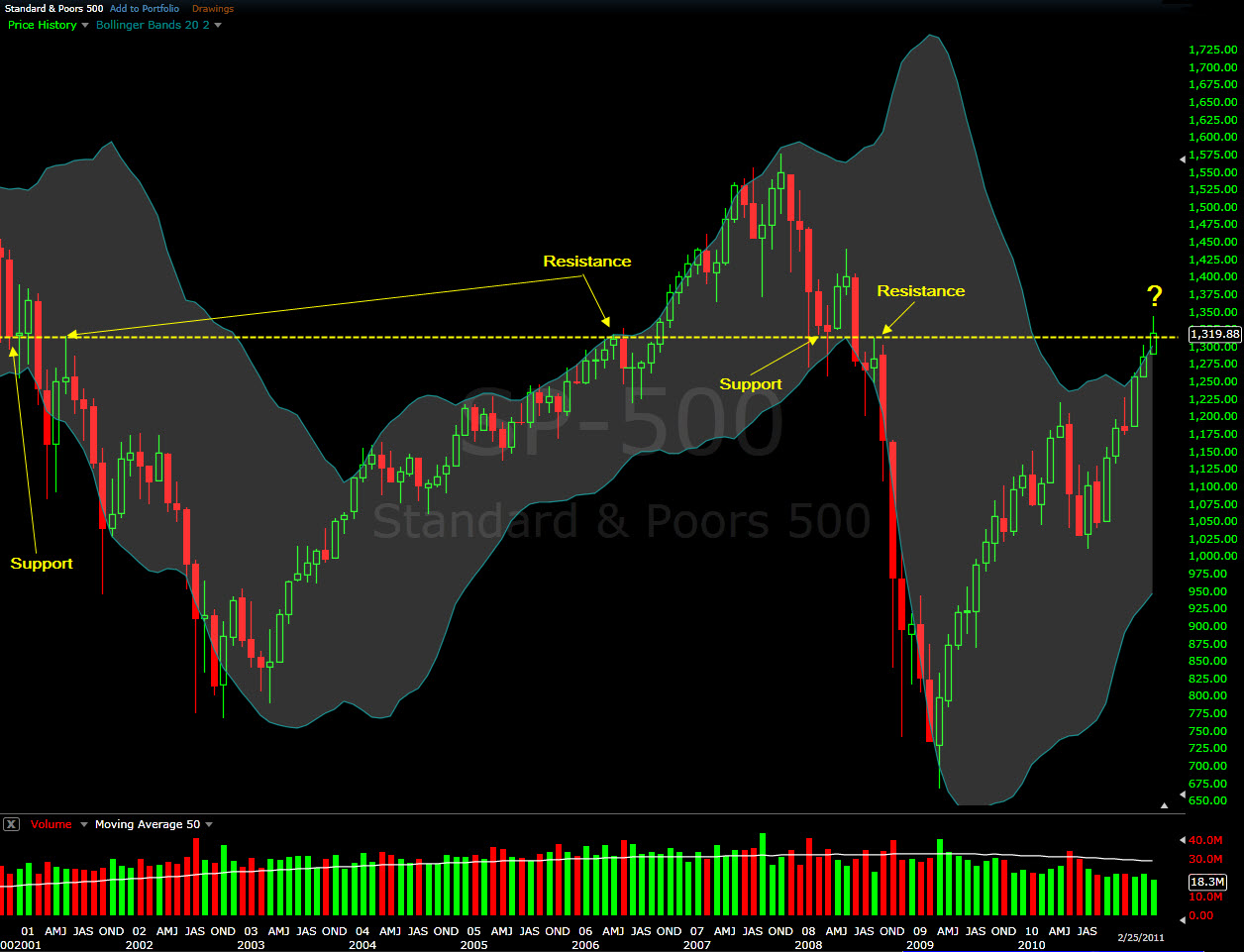

Monday is more than the first day of the week–it is a pivotal day for the $SPX. The area in question is more of a price range because when I draw technical lines on the broader market it works well. In looking at the monthly chart below you can see that the 1315-1318 area has significance for this time frame.

Tuesday brings with it the most bullish seasonal play of the past 9 months, the turn of the month, so that bodes well for a move beyond this area. One problem with that is that the current candle will have already printed by then.

If you look closer you can see that the February monthly candle is still outside the upper bollinger band. While this is atypical, its no guarantee that the market pulls back. In fact, if you look to the last time SPX broke above 1315 it rode the upper bollinger band higher for a few months. What is of concern though is a false break that can occur if Monday’s close is above this area but then catalysts like the non-farm payrolls on Friday send the broader market lower and back underneath this level.