Bit of a sell-off today with the $SPY losing 1.75%. The broader market sliced through the 5 SMA, 13 EMA and 20 SMA while taking out the past 6 days of gains. I’m not too surprised in the price action as the market has been on a slow grind higher for what seems like forever. What is surprising, to me anyway, is that today was a Friday.

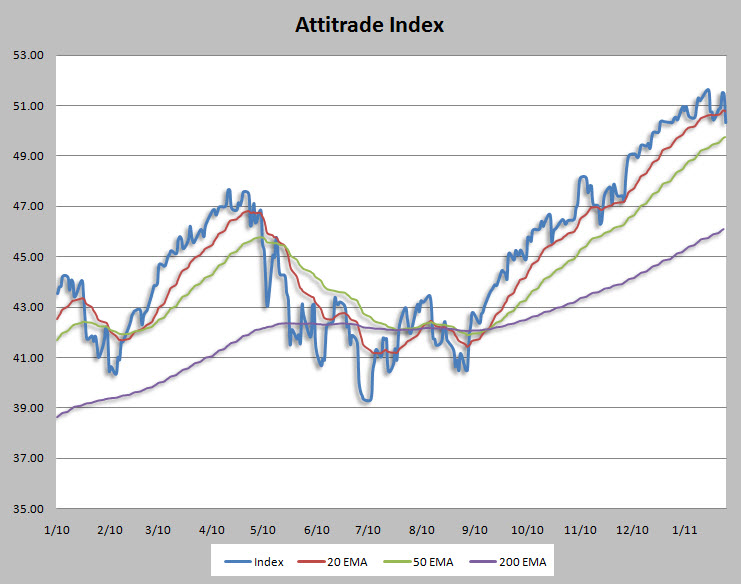

The index*, comprised of several sectors I watch closely, fired a neutral signal today. The last neutral signal given was on the 21st of this month, which was an up day for the broader index. And, unlike the SPY, a lower high was put in after that neutral signal on the 21st. With the index currently sitting under its 20 EMA, a neutral signal and a lower high, the odds have increased for a test of the 50 EMA.

I’m 30% vested on the put side and 20% on the call side for February (I am never vested more than 40% for any one option cycle) and today’s pullback was welcomed as it gave me a chance to increase my put exposure by selling more spreads. Three weeks remain in the cycle and quite honestly I’m glad today’s price action occurred beyond the chance to sell. I’m glad because the market was getting too predictable and that’s never good for me as my confidence swoons which, in turn, alerts me that I need to step away from the market and gain a fresh perspective. Funny thing is though that I was planning on stepping away today but obviously didn’t.

* I’ve made a few adjustments to the index that I track to better serve me as a premium seller. There are slight differences in the number of sectors tracked as well as the signals that are given.