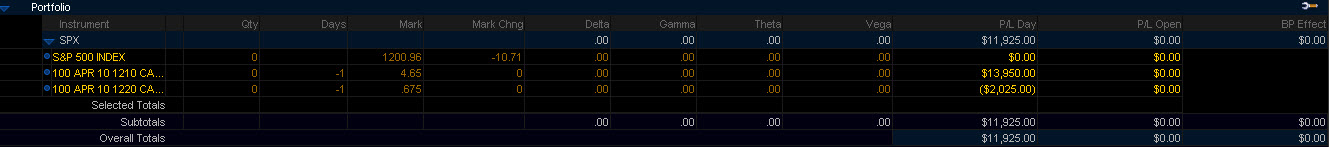

I used to play $GOOG earnings every quarter up until about a year ago and just stopped, don’t know why. Still didn’t play the earnings this quarter but I did sell some premium on the $SPX before the close yesterday. I sold 30 of the 1210/1220 call spreads and took in nearly 4 on the trade so the risk was 6. The prior day’s settle price was 1209.08 and my break-even on the spread was 1214 (1210 strike + 4 premium).

Where $GOOG comes in is that it’s a component of the S&P and so is $GE and $BAC, all had earnings before the $SET price for the SPX was released today. Needless to say, the trade was profitable and netted a nice little bonus this cycle for me as today’s settle price came in at 1207.93. Was it a gamble? In a sense, but I knew what the risk was and defined my break-even and was comfortable with both.