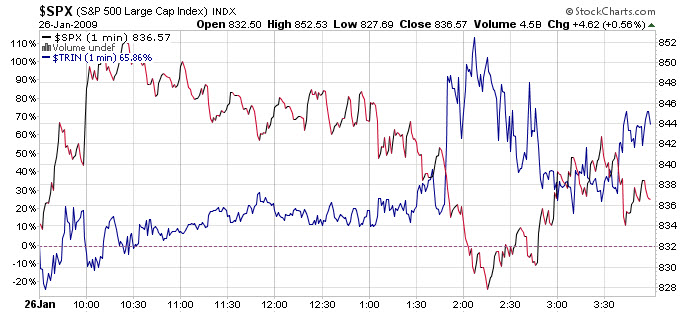

The major indices gave us a bit of a ride today with a jump up at the gun and then falling behind as the day progressed. However, a last leg kick into the close brought the indices back into positive territory for the day. I like to watch the $TRIN during the day to see what the strength of the moves are and it was pretty benign until around 12:30 pm when the selling kicked in. You can take a look at the chart below to see the $TRIN compared to the $SPX for the day. The $TRIN is truly a nice indicator to watch on an intraday basis.

Things are definitely on shaky ground as headlines continue to come in about layoffs, plant closings and downsizing. Home Depot ($HD) said that it was going to cut another 7,000 jobs and close all of their Expo stores to cut costs. Texas Instruments reported job losses of nearly 3,500 with about half of those coming by way of layoffs.

Earnings aren’t coming in that great either, but that was to be expected. What’s not expected are the poor forecasts that are coming in and that’s not a good sign. Unless we see a pick-up in the statements moving forward, we could see a test of the lows again. No stimulus package can compensate for poor forecasts.

Tomorrow we get the S&P Housing Index, consumer confidence, and the Richmond Fed Index. On the earnings front, AKS, AVY, BMS, BMY, CHRW, CVG, CBE, DD, ETFC, EMC, FPL, GILD, JEC, LXK, MOLX, NSC, NUE, BTU, STJ, SYK, JAVA, TLAB, HSY, MHP, TRV, TSS, X, VLO, WAT and YHOO are reporting tomorrow.