The major indices closed mixed today with the Nasdaq being the only one with a positive gain. The biggest impacts were the pending economic stimulus package that is in the Senate, and a bit more rope being given to the banking sector. The stimulus package that brought some upward momentum to the markets last week has proven that it might not breeze through the Senate as expected. As a result, we see the major indices continuing to move lower to sideways.

With the pending jobs data we get on Wednesday and Friday this week we may not see the markets move much beforehand. In addition to the jobs data we’ve seen less than stellar earnings so the once bottom seeking bulls are a bit squeamish. If you look at the chart of the S&P below you can see that we’re still not out of the range we’ve been in for some time. In fact, we are now (thanks to the worst January on record) closer to breaking down and testing the lows from November.

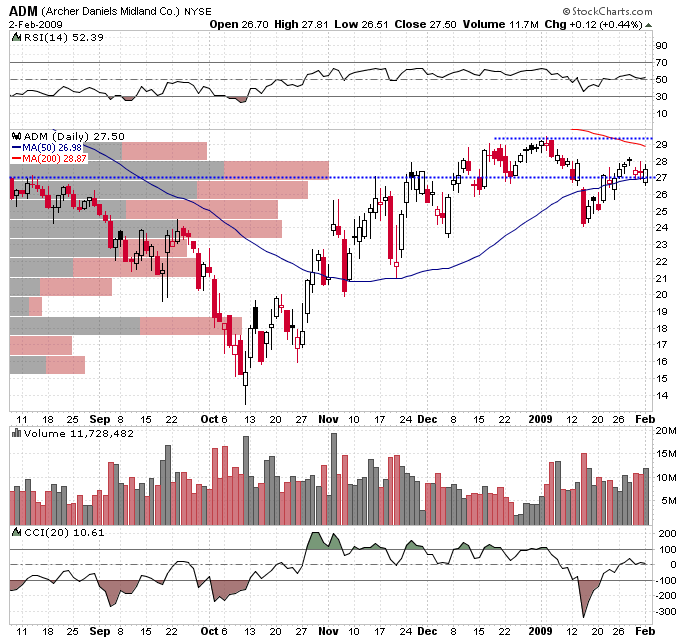

One stock that’s done relatively well since October, Archer Daniels Midland ($ADM), is reporting earnings tomorrow. The company is in the consumer goods sector and deals with agricultural commodities such as corn. Commodities have been hit hard lately but ADM is diversified enough that they also have revenue from oilseed processing and agricultural services. In other words, they provide a lot of what’s needed for some of the bigs in the consumer staples arena. Should be interesting to see how their earnings come in and, more importantly, what their forecast looks like.

Tomorrow we get the pending home sales and total vehicle sales data. On the earnings front, ADM, AVP, ADP, CAM, CME, CMI, DHI, ERTS, EMR, ETR, FISV, LEG, MRO, MEE, MRK MET, MOT, NOC, PXD, PNC, PEG, COL, SGP, DOW, TYC, UPS, UNM, DIS, WEC, and YUM are reporting tomorrow.