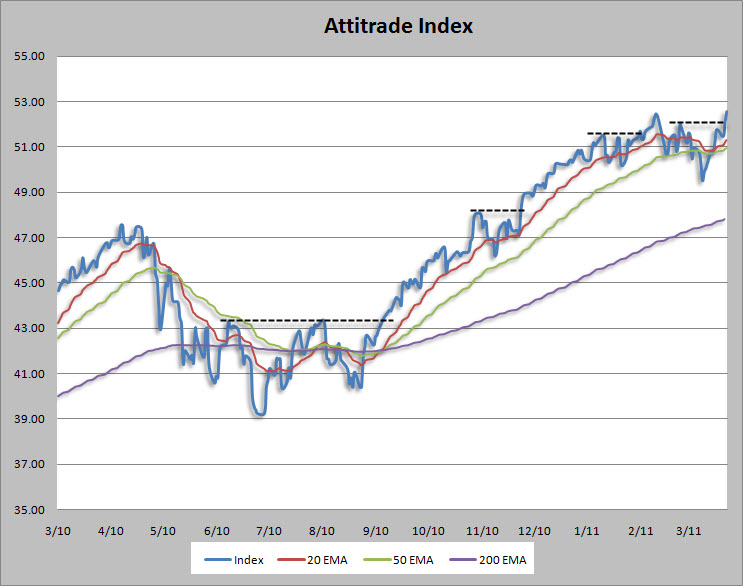

Not quite sure what to make of this, but after today’s price action my index is at a new multi-year high. In fact, my data only goes back to January of 2006 and this is the highest level ever. The last sell signal generated was back on 8/31/10 which was quickly changed to neutral the following day after a massive bullish engulfing candle. Pretty amazing to think that the index has fired either a neutral or buy signal for the last 7 months.

Where do we go from here? Not sure. I have noticed that call premium in $SPX, especially the weeklys, isn’t nearly as attractive as the put premium. Seems that there’s always more premium in the puts, regardless of the cycle. However, this is noticeable to me now more than other times.

I like to use Woodie’s pivots for my weekly premium selling because it uses the open for the current week which accounts for gaps. For this week, R1 is at 1334.21 followed by R2 at 1345.46 so depending on the amount of window dressing left we could test R1 easily tomorrow as it’s only .41% from Wednesday’s close. If we get a bullish reaction to non-farm payrolls on Friday then a trip to R2 is definitely within reach at a mere 1.26% away from Wednesday’s close. I’m pumped for Friday as I think some decisive market action is highly likely.