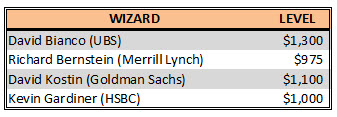

It’s been a decent year for me and as usual my strategy of selling far out-of-the-money spreads has been my best strategy. I’ve never been one to predict levels, especially in the indices, so I always like to see what others think. Below are the 2009 forecasts from a few well known individuals and the levels they’ve predicted for the $SPX at the close of trading in 2009.

*Let it be known that Kostin lowered his level to $940 in late February.

No doubt that 2009 will go down in the record books as one of the craziest, especially for those that were too stubborn to let their ego go and trade price. The run from the ominous 666 level in March to where we are today is simply amazing. Those who didn’t fight the tape and traded the trend did well, extremely well. However, there comes a point when you need to realize that everything gets its energy from somewhere and perhaps that energy has a limited supply…we shall see in 2010.

On that note, one of my favorite “financial people” is Meredith Whitney. Not because she’s married to Bradshaw, but because she says tells it like it is. Plain and simple. Take this snippet from late 2008

What happens in 2009? Frankly, it’s hard for me to predict what’s going to happen next week, never mind next year. What I will say is that I expect all these banks to be back in the market looking for more capital. We’ll also have a wholesale restructuring of our banking system, probably toward the end of 2009. There will be banks getting smaller, banks going away, and banks consolidating. At the same time, though, I think you’ll see more new banks created. We’ve already seen more applications. And it’s a great idea: You start with a clean balance sheet and make loans today with today’s information. Plus, right now you’ve got a yield curve that’s good for lending.

I think the overall economy will be worse than people expect. The biggest issue will be consumer spending. If 2008 was characterized by the market impacting the economy, then 2009 will be about the economy impacting the market. It’s already started.

Great stuff there from Meredith and others are out there as well. The issue it seems is getting that pipeline into a manageable form or even forum and that’s where stocktwits comes in. Every day I can find someone tweeting about stocks and I follow those that make sense to me and watch others. As appropriate I add them to my stream and build my own research team that creates potential trade ideas. I’m glad to have found stocktwits and for the friends that I’ve made from it. I’ve also made some decent trades based off of people I’ve never met. Not just on a whim, but rather because I agreed with what they were seeing and acted upon it using my risk management.

Stocktwits has a great stream on 2010 predictions and you can follow that here and add your own as well. Here’s to a great 2010 for all of us!