What is an Iron Condor?

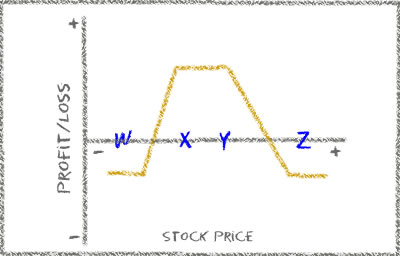

Iron Condor Spread Defined: Combine a Bearish Vertical Credit Spread and a Bullish Vertical Credit Spread on the same underlying security. By doing this, an investor will potentially be able to double the credit obtained over a single spread position. Since there are two spreads involved in the strategy (four options), there is an upper break even and a lower break even. A profit is made if the stock remains above the lower break even point or below the upper break even point.

What it means: When you enter an Iron Condor, you are actually entering 4 options orders at once. If the stock stays within a specific range, you profit, and if the stock moves out of the desired range, you lose.

EXAMPLE: Take a look at what the order looks like on a Iron Condor on the stock QQQQ where we buy 1 call option with a strike of 43 and sell 1 call option with a strike of 42 as the “upper” Vertical Spread AND sell 1 put option with a strike of 38 and buy 1 put option with a strike of 37 as the “lower” Vertical Spread. The result is a complete trade that gives us a .55/contract ($55) CREDIT to our account (for each contract we choose to do).

The price of QQQQ at the time of this trade was 40.09.

EXAMPLE: Now look at the profit and loss scenarios that could occur on the trade we entered above. You will notice that if QQQQ closes ANYWHERE between 38.00 and 42.00 on expiration day, we PROFIT $55 on the trade. Above 42.55 and below 37.45 we start to lose on the trade, with a MAXIMUM loss of $45 total.

To learn more about iron condors, condors, butterflies, iron butterflies, and all sorts of credit spreads, simply enroll in our education. We offer a risk-free 14-day trial so you can get your feet wet without risking a penny.