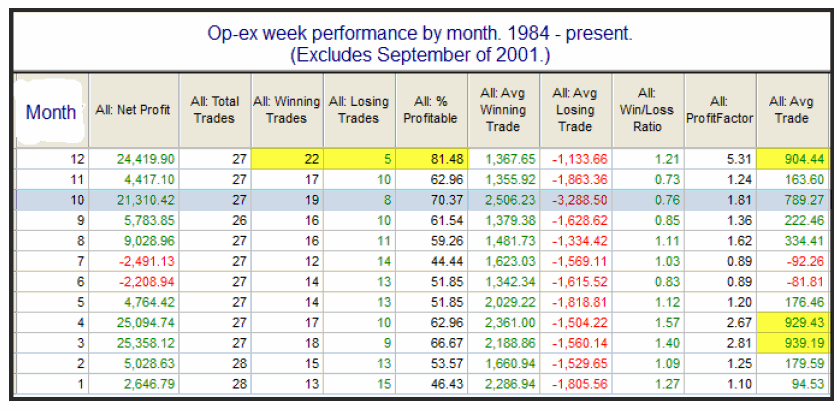

The MLB playoffs isn’t the only wild event going on in early October. We are entering option expiration! And it’s an election year as well. Rob Hanna (@QuantEdges) over at Quantifiable Edges was nice enough to let me share the graphic below. This setup looks at buying the S&P 500 the Friday before option expiration and selling that position 4 days later.

October is the 4th best performing month in this setup with a profit factor of 1.81 and a win rate of over 70%. You can also see that the month of October can also be the cruelest with an average loser that is significantly greater than other months. The above results exclude 2001 for obvious reasons but 2008 needs to be looked at as well. Rob pointed out that an 11.5% gain on the Monday of opex week in 2008 skews the results above but that they were still bullish for the week.

Not only was 2008 an election year but a wild move overall in the market. October opex opened at 95.35 and closed at 79.52 for a -15.8 point loss for the cycle. However, two weeks later the close for the month of October was at 96.83 for a whopping 21.8% gain. Wild!

As a premium seller I’m typically looking to sell the next month’s options during the front month’s option expiration week. Therefore, I like to know what does the overall option cycle look like instead of just option expiration week. I’m talking about the Monday after option expiration to the next option expiration Friday. Here’s a few stats that I’ve collected for the SPY for October’s option expiration since 1994. [list type=square_list]

- The average gain for the month of October is +1.75

- The average move for the option cycle is +2.24

- The largest loss for an opex was in 2008 with -15.8 points (noted above)

- The largest gain for an opex was 1999 with +17.6 points

- The average move from the 1st of the month to opex Friday’s close is +2.57

- The average move from the first Monday after opex to the end of October is -.82

1996, 2000, 2004 & 2008 were all election years but there was nothing notable regarding those option cycles other than 2008 which was mentioned above. Probably the biggest edge is that during opex weeks the Monday’s were the biggest gainers. We have some short-term indicators that suggest the market is oversold but nothing with an extreme reading. A gap down Monday (China has inflation data Sunday night) could provide an ideal risk/reward setup for longs. One caveat is that the Wednesday of October option expiration has produced some big moves lower (e.g., 2008 gave back all the Monday gains on Wednesday but finished higher for the week). Bottom line is that October opex can either be very good or very bad depending on how you are positioned as the moves can be larger than average.