Wednesday’s selling was more than just mom and pop worried about the fiscal cliff that they’ve been inundated with of late. In fact, if you look at this chart you can see that there has been relentless selling since the election was called Tuesday night and the cash market opened Wednesday. Perhaps THIS is the reason.

I’m a technical trader that sells premium so my horizon goes out about 30-60 days at a time. I like to sell front-month options when we get a push beyond what I’d call reasonable price movement. Below is a chart of the November expiration, which has two days of trading left, for the $SPY.

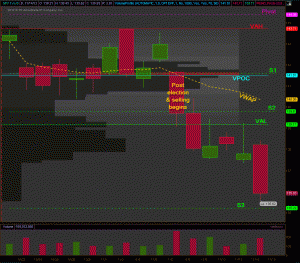

In the chart above you can see that the $SPY is fast approaching the third level of support (S3) for the November expiration.These pivots are formed based off the prior option expiration and I use them religiously in my trading. You can see that price has moved outside the value area (70% of the trading volume) and -4.1% away from the volume point of control (VPOC). Take a look at this chart to see how unusual this price action is for 2012.

I’d like to think that 135.22 (S3) would be defended through opex. Keep in mind that I closed out my November positions on Wednesday. I do have a small position in $XIV that I’ve been wanting to add to but price hasn’t come to my comfort level yet. What happens post opex is a mystery. A bounce seems inevitable but for anyone that traded through 2008 knows that line of thinking is more akin to gambler’s fallacy.

I will be playing, small, the Thursday open to Friday close stat in the $SPY this week. This position will be closed sometime Friday as per my trading rule. Other than that I’m not sure I want to have any positions going into next week. However, a gap down on European GDP data or the Producer Price Index (PPI) would have me looking in the weekly options for some short-term put spreads to sell.

Great post, Darren. Tomorrow (Thurs.) I’m looking to start a weekly SPX vertical trade. Sell the 10 delta put and buy one strike lower. Won’t enter the trade if I can’t get 5% return on risk. Max loss is 20% of risk.

I like it. Have you ever traded SPXpm options? They give you that extra day without the risk of overnight movement that you get with SPX.

I really like how you have the volume profile levels notated on your charts. Very helpful. I agree with you on the bearishness, and I also think that the whole world is looking for the bounce. Which will probably lead to more selling, especially in the SPX.

Yea, I could easily see a weak bounce of 2-3 days maybe up into the 13 EMA then a lower low.