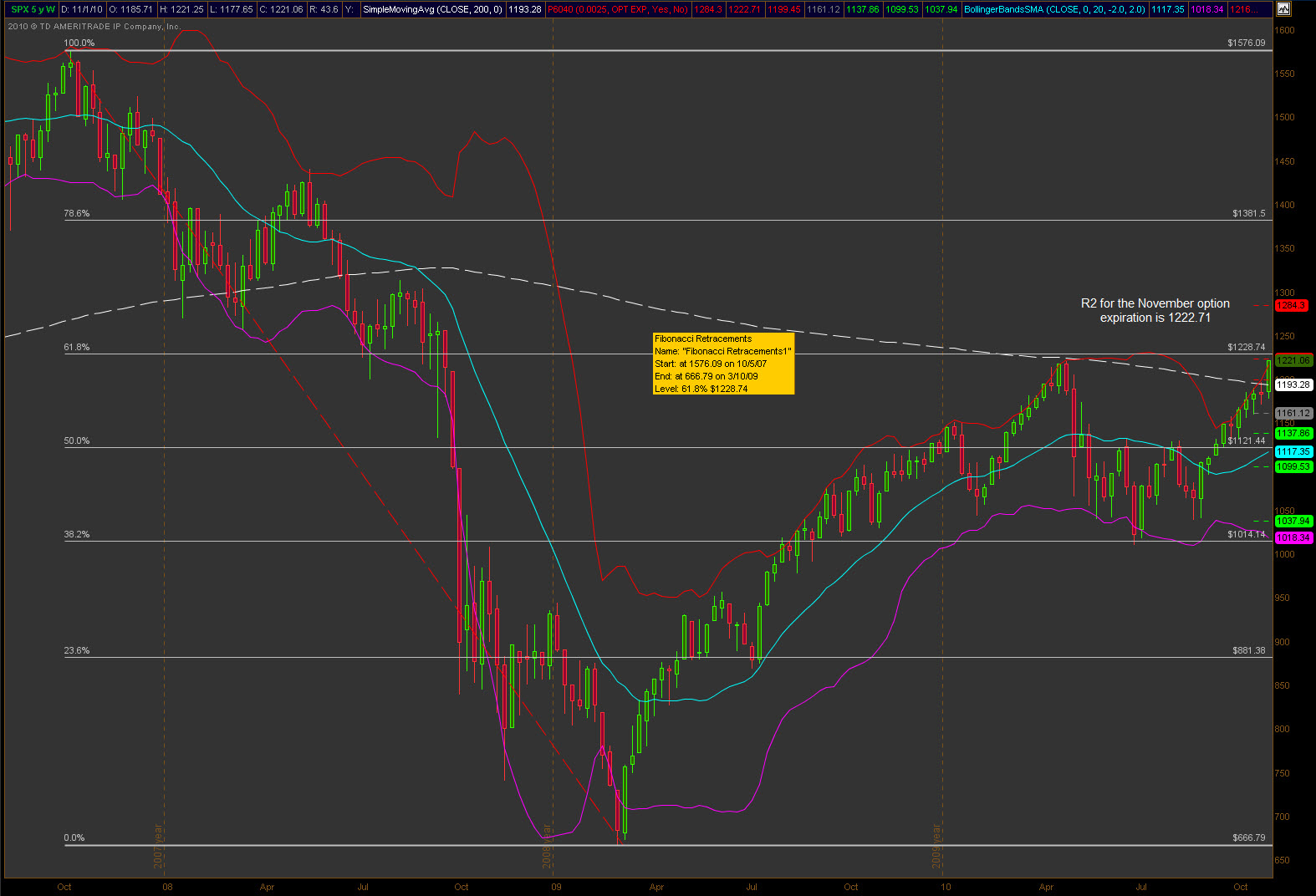

Quite the day for the broader market, weird actually, but bullish nonetheless. Those that tried to fade had their assets handed to them. The greater risk at this point though is trying to buy in here to catch the next leg up. Take a look at the chart below and you’ll see that there is a fib level at 1228.74. The November option expiration R2 at 1222.71. We are also trading outside the upper bollinger band on the weekly candles. Add to the mix the non-farm payrolls tomorrow morning and you can see where I’m coming from.

If we break higher on the data then these levels will be tested in short order. The fib level should provide some resistance or at least a pause. If the market moves lower on the data there’s plenty of room to fall so the ceiling is closer than the floor here. Obviously we’ve never had circumstances like we have now so anything can happen, right?

On days like today I run a scan that looks at stocks that moved 10% above their daily pivot points. If the market reacts negatively to the jobs data tomorrow these names could be candidates. These are only names and no due diligence has been done to assess why the move occurred. High risk trades, no question. With that warning, here are the names:

10% above R1

$TSLA

10% above R2

$BGC

$CELL

$DGIT

$IO

$MTZ

$SVM

$UNTD

$WFMI