Disappointing week for me as a premium seller because I was only able to enter a 10% position on some put spreads that fit within my risk parameters. I typically like to get at least 20% (I never invest more than 40% of my capital per option cycle) on both call spreads and put spreads, but this past week the market would have nothing to do with me and my risk tolerance. May did end nicely for me when Friday morning rolled around and I’m pleased with the results, but I was looking for much more in the way of my June position.

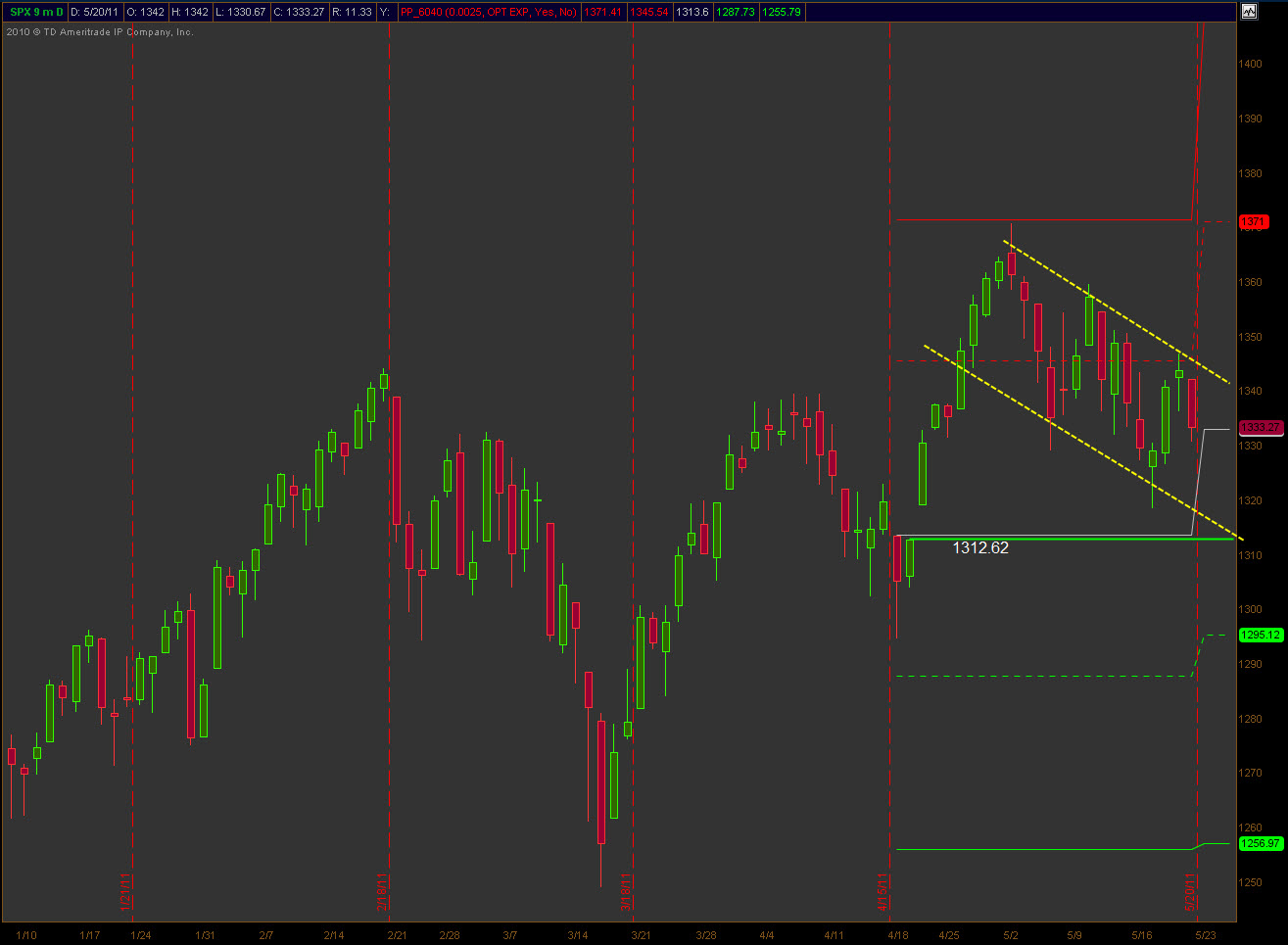

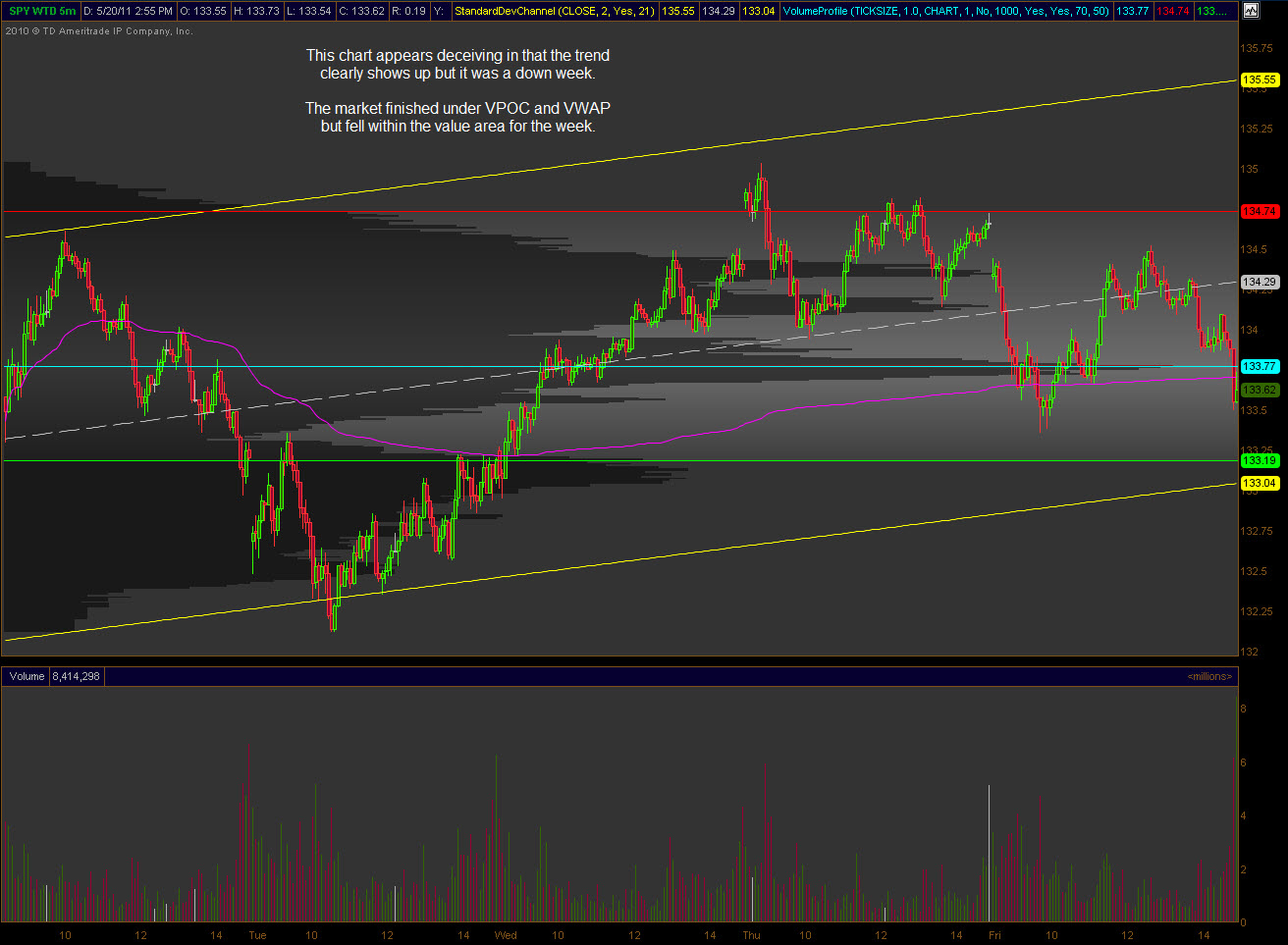

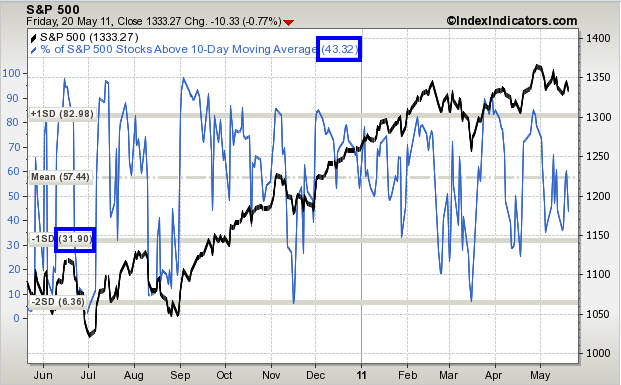

The market reeks of indecision here and is basically stuck in a 25 point decision area (1350-1325). The case could be made for either the bulls or bears at this point and with options expiration last week it was highly unlikely that we’d see a break. That all changes this week and there are a few catalysts out there that could get the ball rolling.

Last week saw soft numbers for most of the economic indicators which would suggest a slowdown in the “recovery”. Of the few reports we have this coming week, the preliminary GDP on Thursday stands out the most for me. I believe it will be important to watch the weekly claims as well as last week’s number showed a larger than forecast drop so it will be interesting to see if that trend continues. Durable goods are released Wednesday and the week is book ended by some housing data with new home sales and pending home sales.

I’m well aware that with the Summer fast approaching the coming option cycles will not be as nice as the most recent ones. I’m up nicely for the year so I feel no need to press and take on unnecessary risk for the chance to make a profit. The opportunities will present themselves, all I need to do is exercise patience and stick to what has worked well for me. I’ve got plenty of projects to occupy my time should the market not meet my risk tolerance.

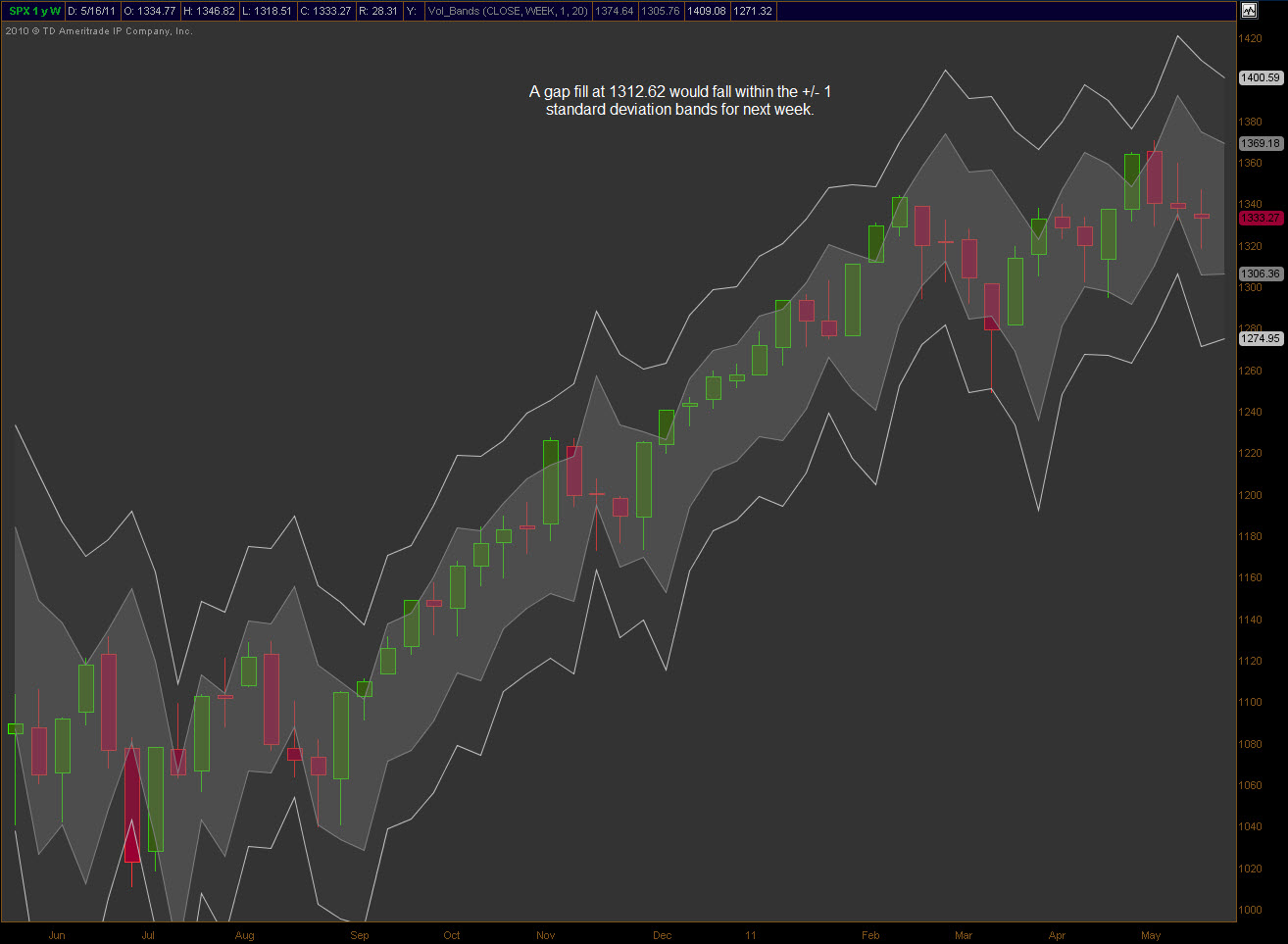

Bottom line is that it appears more likely that the gap at 1312.62 gets filled this coming week. Memorial day isn’t that far off and historically the market hasn’t done well the week before Memorial day. That gap could be considered low hanging fruit at this point so I’m anticipating negative price action early this week and will be looking to sell some put spreads. The caveat in all the well laid plans that are out there remains the $DX_F and what happens with the high inverse correlation between it and equities.

It’s interesting how we all differ. I’ve already exited every one of my June iron condors and am waiting for tomorrow do open August.

Mark

Agree completely. I like the rapidly decaying Theta of the front-month options but have, on occasion, gone out two or three months. I guess if we were all the same we wouldn’t have a market. Thanks for posting, Mark.