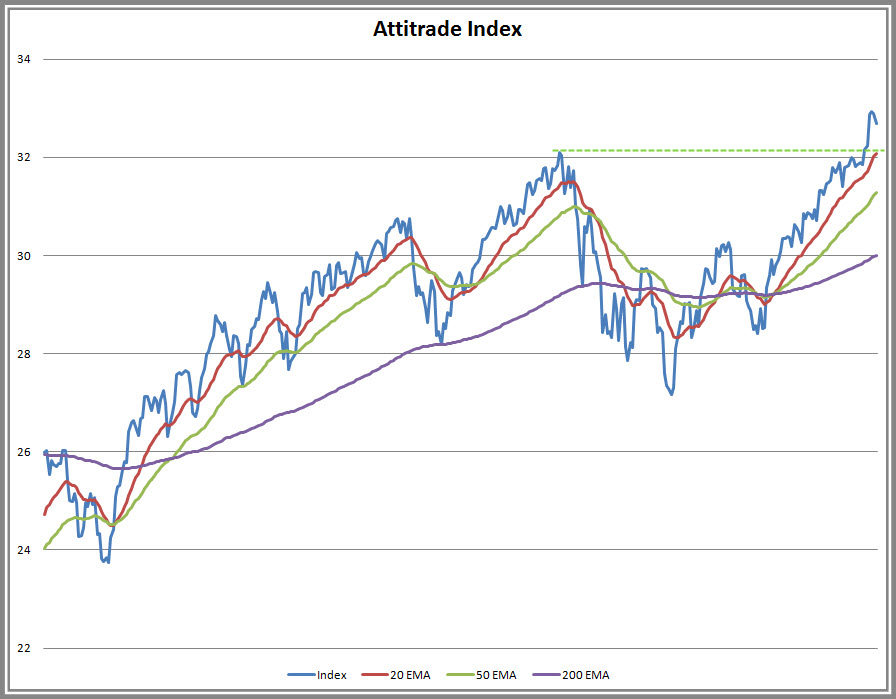

The index pulled back slightly Tuesday, down to 32.68 from its yearly high of 32.94 achieved last Friday. The more recent price action has moved the index significantly away from the 20 EMA and when that’s happened in the past there’s been a pullback. In other words, it was expected to either pullback or trend sideways and let time correct the averages.

A pullback to the 20 EMA would position the index where it could test prior resistance as new support. This type of price action would be healthy and welcomed. A close under the 20 EMA would more than likely signal a test of the 50 EMA. It’s difficult to gauge since the rate of a descent to that level is unknown but assuming that confluence still exists it should provide support.

I use this index to guide me in determining how far out-of-the-money I write my $SPX spreads each cycle. It’s never too early to start watching certain strikes, especially as we approach the end of the November cycle. Puts have been much closer than calls the last few cycles but December may change that theme.